Google just did something unusual for a tech company: it stopped talking about gigahertz and started singing show tunes.

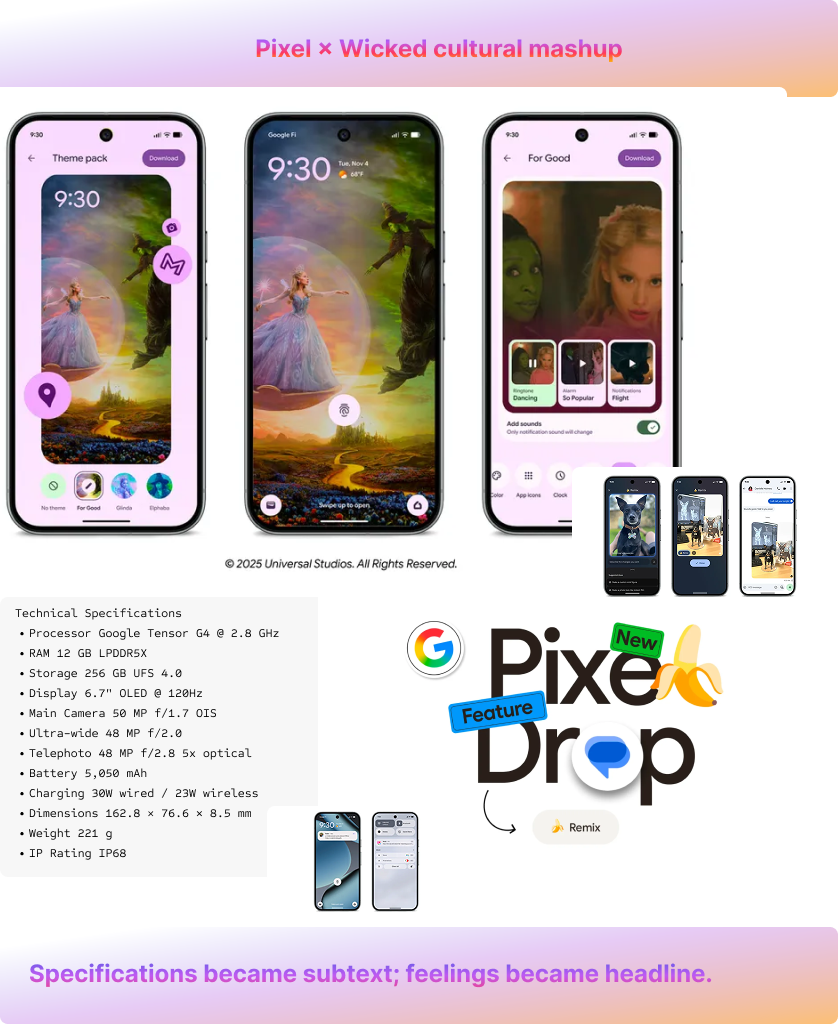

The November 2025 Pixel Drop campaign—four short videos promoting everything from Wicked-themed wallpapers to an AI feature called Nano Banana—represents more than clever product marketing. It’s a calculated wager that consumers care more about cultural participation than technical specifications, that entertainment partnerships can achieve what traditional tech marketing cannot, and that the line between your smartphone and your identity has essentially vanished.

The timing is deliberate. Universal Pictures orchestrated an unprecedented $350 million promotional campaign for Wicked, saturating retail spaces, theme parks, and 40+ international broadcasters with pink and green branding that reached 2 billion shoppers. Google didn’t just buy into this cultural moment—it embedded Pixel at its centre, making the phone a canvas for expressing your relationship with Elphaba and Glinda.

The results speak volumes about where consumer technology marketing is heading, and the challenges facing every brand trying to cut through in 2025’s fractured attention economy.

The cultural play that tech forgot

Here’s what makes this campaign worth dissecting: Google recognised something its competitors apparently missed. Whilst Apple positions itself through professional creative tools and premium materials, and Samsung leads with hardware specifications and display technology, Google chose vibes.

The Wicked theme pack video opens with “Your phone, re-enchanted” and delivers exactly that—custom wallpapers that shift your mood, icon sets, sounds, and Gboard GIFs creating what Google calls “a fully immersive way to personalise Pixel”. It’s marketing that acknowledges your phone isn’t a productivity device; it’s an extension of your aesthetic and emotional identity.

This cultural-first approach yielded immediate dividends. Wicked opened to $112.5 million domestically, becoming the biggest musical opening in history and generating 25 billion impressions across Universal’s ecosystem. Every cinema queue, every retail partnership, every social media conversation became Pixel-adjacent.

Google effectively rented the world’s attention for a fraction of what building that awareness independently would cost.

But here’s the strategic sophistication: the campaign wasn’t just about Wicked. Three additional videos promoted AI-powered features—Nano Banana Remix for image editing, Notification Summaries for managing information overload, and upgraded Pixel VIPs for relationship prioritisation. Each addressed authentic human needs: creative expression, stress reduction, meaningful connection. The technical implementation—Gemini AI, machine learning, natural language processing—remained secondary to emotional positioning.

This represents a fundamental shift in how technology gets marketed.

Specifications became subtext; feelings became headline.

When viral moments validate your strategy

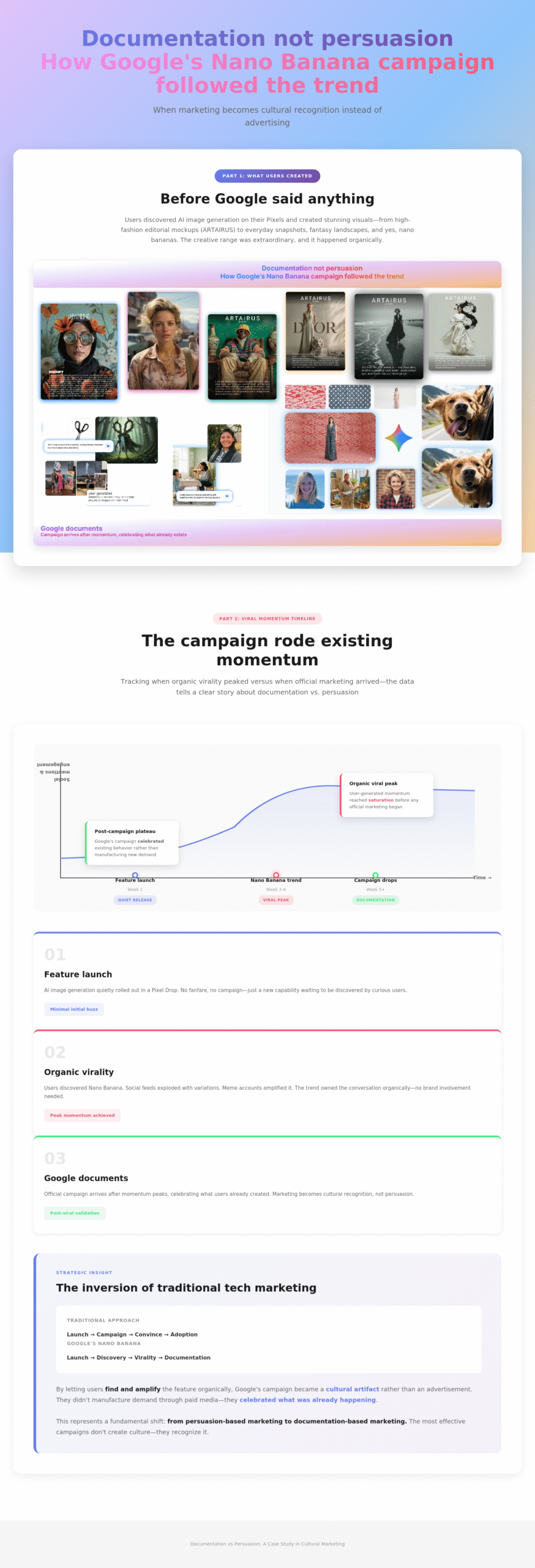

The campaign’s second strategic advantage emerged from fortunate timing: Nano Banana was already viral before Google spent a penny promoting it.

By September 2025, users had generated over 500 million Nano Banana images globally, with India leading adoption so aggressively that daily Gemini app downloads surged 667% to 414,000. When Nvidia CEO Jensen Huang praised the feature at a London tech event—”How good is that Nano Banana?”—and Alphabet CEO Sundar Pichai amplified the moment on social media, Google gained something money can’t buy: C-suite validation and authentic advocacy.

The campaign video simply rode this organic enthusiasm, positioning Nano Banana Remix as the next evolution of an already-beloved feature.

Marketing became documentation rather than persuasion.

This is the dream scenario for consumer technology: when your product generates cultural conversation independent of advertising spend. Apple achieved it with AirPods (the white earbuds as status symbol). Samsung managed it briefly with the Galaxy Note (stylus as productivity differentiator). Google’s Nano Banana success demonstrates that AI features can transcend tech-enthusiast audiences when they enable creative expression rather than optimisation.

But there’s a darker interpretation. Some critics argue these viral AI trends function as “emotional junk food”—superficial entertainment that diverts attention from substantive issues. One analysis noted: “When the Nano Banana filter has 20 million downloads, but a government report on rising cases of depression amongst teenagers barely registers, you have to ask, where are we directing our collective gaze?”

This tension mirrors the broader challenges facing September’s smartphone marketing landscape, where every device now claims revolutionary AI capabilities whilst consumers increasingly struggle to distinguish genuine innovation from marketing theatre. Google’s campaign doesn’t address this tension. It simply accelerates it.

Short, sharp, and strategically fragmented

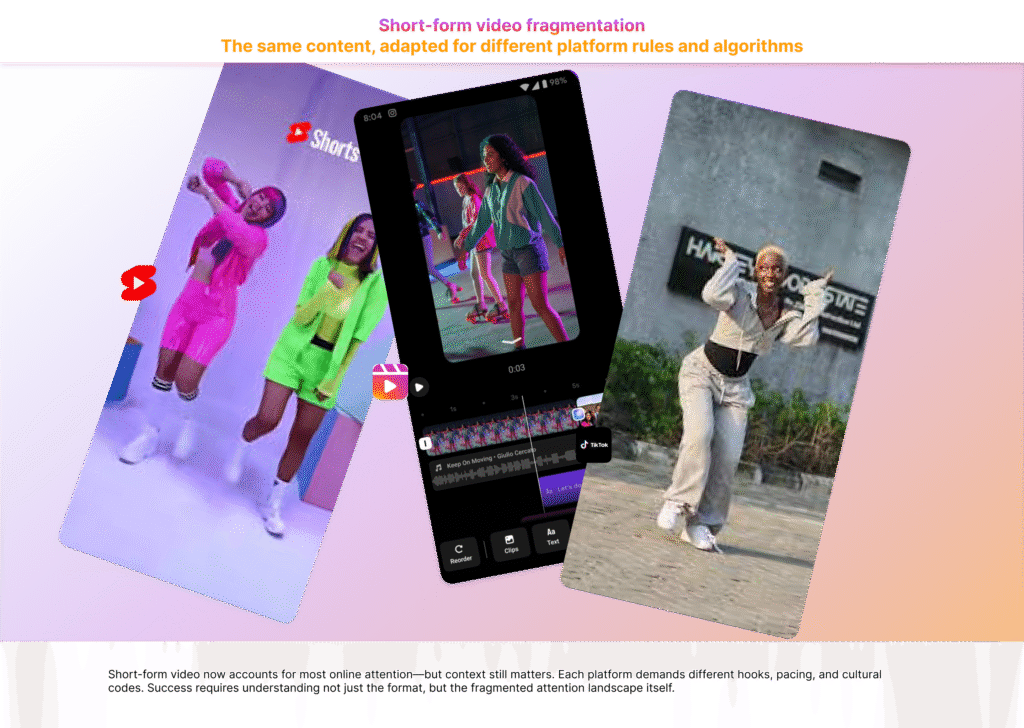

The videos themselves reveal sophisticated understanding of platform dynamics. Each runs 30-79 seconds—the sweet spot for YouTube Shorts and cross-platform distribution. Research shows videos under 90 seconds retain 50% of viewers, whilst longer Shorts can perform as well as sub-15-second content when delivering educational value.

The creative execution maintains exceptional consistency. Visual identity—colour palettes, typography, iconography—remains uniform across all four videos. Musical choices create thematic groupings: Wicked and Nano Banana use playful, entertainment-focused tracks; Notification Summaries and VIPs share “Make It Look Easy” by Daisha McBride, sonically connecting productivity features under a unified message.

This coherence matters more than ever. Short-form video now accounts for over 90% of online traffic, with platforms algorithmically favouring bite-sized content. But platform fragmentation creates new challenges: what works on TikTok (fast, entertaining clips with trending audio) differs from YouTube Shorts (SEO-optimised, loopable content) and Instagram Reels (polished, shareable aesthetics). Google’s approach—creating platform-agnostic content distributed omnichannel—represents a bet on consistency over customisation.

The gamble appears justified. The campaign achieved substantial earned media across major Indian publications (India Today, Times of India, Hindustan Times) and international tech outlets, extending reach far beyond paid distribution. When your owned content generates press coverage, you’ve essentially doubled your investment. Compare this strategic coherence to how Swiggy’s Wiggy campaign embedded itself into culture—both demonstrate that unified messaging across fragmented platforms outperforms channel-specific customisation when authenticity remains paramount.

The accessibility problem hiding in plain sight

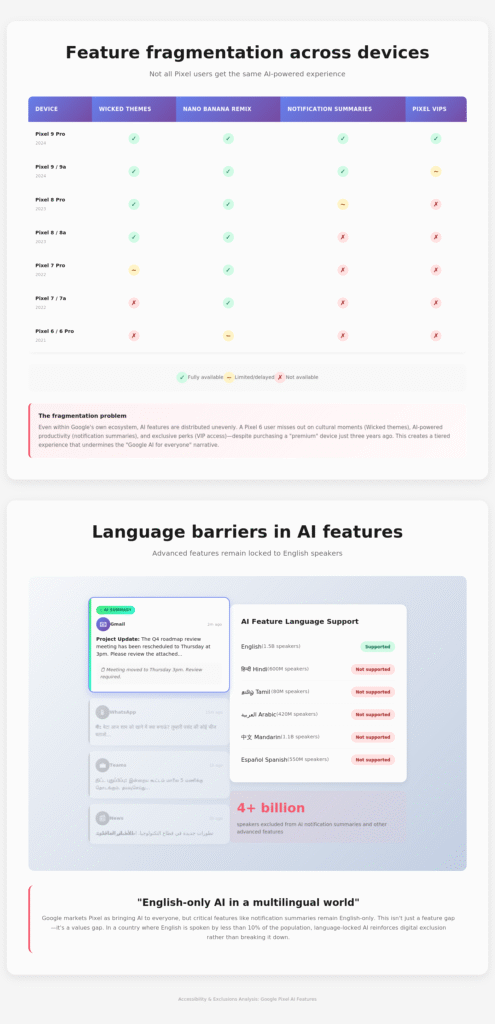

Here’s where the campaign stumbles: feature availability is maddeningly inconsistent.

Wicked themes work on Pixel 7a and newer initially, expanding to Pixel 6 lineup in December. Nano Banana Remix functions on Pixel 6+. Notification Summaries require Pixel 9+ (excluding Pixel 9a) and only work in English. Pixel VIPs operate on Pixel 6+.

This fragmentation creates genuine confusion. A prospective buyer watching these videos cannot easily determine which features their potential purchase will support. An existing Pixel 6 user sees four advertised features but can only access two immediately, with a third arriving eventually and the fourth permanently unavailable.

More problematically, the English-only limitation for Notification Summaries contradicts Google’s inclusive positioning and global distribution. In India—where Nano Banana achieved extraordinary adoption—users speaking Hindi, Tamil, Telugu, or any of the country’s 22 official languages cannot use notification summaries despite owning compatible devices. The Pixel 9a exclusion particularly stings: budget-conscious consumers who chose the more affordable model discover they’ve been locked out of AI features their premium-paying counterparts enjoy.

This isn’t oversight; it’s strategic prioritisation. Google chose feature velocity over feature breadth, shipping English-only to market faster rather than delaying for multilingual support. But the marketing doesn’t acknowledge these limitations upfront. You discover device incompatibility buried in video descriptions, not in opening title cards.

For a campaign emphasising inclusivity and cultural participation, these barriers feel contradictory—a gap Maybelline’s Mumbai campaign similarly struggled with when promising cultural authenticity whilst deploying CGI rather than real human representation.

The AI fatigue nobody’s discussing

Every video prominently features Gemini branding. Notification Summaries are “powered by Gemini”. Nano Banana runs on Gemini models. The campaign positions Pixel as the AI-first smartphone platform, directly contrasting with Apple’s delayed and fragmented Apple Intelligence rollout.

This differentiation makes competitive sense—Google’s AI infrastructure provides structural advantage over hardware-focused rivals. But the concentrated AI messaging carries risk in a market experiencing genuine fatigue.

Consumer sentiment research reveals troubling patterns. An EY Pulse survey found 50% of senior business leaders report declining company-wide enthusiasm for AI integration, whilst 59.9% of consumers now doubt the authenticity of online content due to AI-generated material. A Qualtrics study tracking nearly 24,000 consumers found comfort using AI has actually declined, with concerns over human connection increasing.

The gap between hype and reality grows wider. As one analysis observed: “AI failed to find end users willing to pay for its services in 2024, even with the technical prowess of its proof-of-concepts. The reason may be that user experience has been an afterthought for many AI projects focused on demonstrating algorithmic power.”

This challenge extends to Google’s broader AI positioning strategy, where even celebrity partnerships struggle to bridge the authenticity gap between AI capability claims and actual consumer utility. Google’s campaign cleverly sidesteps this by anchoring AI features in relatable outcomes rather than technical capabilities. You’re not buying “machine learning-powered notification summarisation”—you’re getting relief from information overload with a feature that helps you “skip the scroll and breathe easy”. This human-centred framing represents sophisticated positioning that could provide a template for how AI gets marketed going forward.

But the sheer volume of AI messaging—every single feature prominently branded with Gemini—risks triggering the very fatigue consumers increasingly report.

When everything is AI-powered, AI becomes meaningless.

What this reveals about premium market positioning

Google’s aggressive cultural play comes from a position of both strength and desperation.

The strength: Pixel became the fastest-growing premium smartphone brand with 105% year-over-year growth in the first half of 2025, breaking into the top five vendors for the first time in five years. The Pixel 9 series drove this surge through “strong performance, expansion into newer markets, and more aggressive marketing efforts”—exactly what this campaign represents.

The desperation: despite explosive growth, Google captured just 3% of the U.S. market and 5% globally, whilst Apple maintained 62% of the premium segment and Samsung held 20%. Pixel remains fundamentally niche despite premium pricing and sophisticated marketing.

This creates an interesting strategic challenge. Google cannot compete on hardware specifications (Samsung wins), ecosystem integration (Apple dominates), or price (Chinese manufacturers undercut everyone). Cultural relevance becomes the remaining differentiation vector—positioning Pixel as the creative expression platform for people who view their phone as identity amplification rather than productivity tool.

The Wicked partnership executes this positioning brilliantly. It targets mainstream consumers rather than tech enthusiasts, prioritises aesthetic customisation over technical capability, and leverages entertainment infrastructure to reach audiences tech marketing typically cannot access.

If you’re building a phone for 3% of the market, you’d better make that 3% feel culturally significant rather than numerically marginal.

The measurement challenge nobody solves

Here’s the uncomfortable question: how does Google actually measure this campaign’s success?

Traditional metrics—view counts, engagement rates, click-throughs—tell only partial stories. The videos generated substantial organic reach through press coverage and social amplification, making paid-versus-earned attribution essentially impossible. The Wicked partnership provides massive exposure through Universal’s promotional infrastructure, but isolating Pixel-specific impact from general film marketing requires sophisticated modelling.

Feature adoption becomes the obvious success indicator, but quarterly drops primarily serve retention and engagement rather than new customer acquisition. If the campaign drives Wicked theme pack downloads amongst existing Pixel users, that’s valuable but fundamentally defensive. If it persuades iPhone users to switch when Pixel 10 launches, that’s transformative but nearly impossible to attribute months after exposure.

Arts and cultural marketing research suggests this measurement complexity isn’t unique to Google. One analysis notes “some KPIs can be a little bit more complicated” when tracking broader social impact or audience engagement, recommending qualitative research and brand awareness studies alongside quantitative conversion data. Brand partnerships like KitKat’s Spotify integration face identical measurement challenges—the cultural value often exceeds what traditional attribution models can capture.

The most honest answer? This campaign’s true success won’t be knowable for months, perhaps years. If Pixel transitions from “tech enthusiast phone” to “creative lifestyle device” in consumer perception, this cultural moment helped. If Google’s market share continues climbing whilst Apple’s shrinks, the aggressive entertainment partnership strategy validated itself. But isolating this campaign’s specific contribution requires measurement sophistication most organisations don’t possess.

What marketers should actually learn from this

Strip away the Wicked spectacle and Nano Banana virality, and several transferable principles emerge:

Cultural integration beats interruption.

Google didn’t advertise during the Wicked moment; it became part of the moment. This requires genuine creative collaboration rather than media buying—harder to execute but exponentially more valuable when successful. Swiggy’s approach to embedding itself within culture demonstrates this principle at scale, transforming delivery partners from background elements into cultural protagonists.

Feature clusters tell better stories than hero products.

The four-video approach enabled audience segmentation (entertainment fans, creative users, productivity seekers, relationship prioritisers) whilst maintaining unified campaign identity. Each video addressed different needs under consistent branding, making the campaign feel comprehensive rather than scattered.

Demonstration beats aspiration for software.

Every video shows actual interface interactions rather than aspirational lifestyle cinematography. This builds credibility (“it actually works like this”) whilst reducing cognitive processing requirements. For digital products, proof of functionality often persuades more effectively than emotional storytelling.

Emotional positioning requires operational follow-through.

The campaign’s weakest elements—fragmented device compatibility, English-only limitations, staggered rollout timing—stem from operational constraints undermining emotional promises.

Marketing can position your product as inclusive and accessible, but if execution excludes non-English speakers and budget-conscious buyers, the positioning rings hollow.

This operational-marketing misalignment appears repeatedly across tech brands, from Maybelline’s representation promises to broader smartphone marketing contradictions.

Viral momentum compounds or contradicts messaging.

Nano Banana’s organic success provided enormous tailwind, but Google couldn’t control the conversation or ensure it aligned with brand values. When your feature goes viral for creative expression but critics frame it as societal distraction, you’re riding momentum that could veer in unwanted directions.

The larger question nobody’s asking

This campaign works—by most reasonable measures—because it does what effective marketing should: creates awareness, generates consideration, strengthens brand perception, and drives feature adoption amongst target audiences.

But it also represents capitulation to a broader cultural shift where smartphones stopped being tools and became identity infrastructure. Where personalisation evolved from helpful convenience to psychological necessity. Where your lockscreen aesthetic carries social meaning and your notification management strategy becomes a statement about values.

Google didn’t create this shift. It simply recognised and monetised it more effectively than competitors currently are.

The question for marketers isn’t whether to follow Google’s playbook—cultural partnerships, short-form video, emotional positioning, viral amplification. These tactics work, and the data proves it.

The question is whether we’re comfortable with what we’re building.

Technology that enhances human capability or technology that mediates human identity?

Products that solve problems or products that create dependency? Marketing that reflects culture or marketing that manufactures it?

Google’s Pixel campaign doesn’t answer these questions. It doesn’t even acknowledge them.

And that, more than any individual tactic or strategic choice, might be the most revealing thing about it.

Footnotes:

- Deadline, “‘Wicked’ $350 Million Promo Campaign Is A Hollywood Record”, November 2024

- The Numbers, “Wicked (2024) – Box Office and Financial Information”, November 2025

- Times of India, “Nano Banana AI trend takes over the internet”, September 2025

- TechCrunch, “India leads the way on Google’s Nano Banana”, September 2025

- India Today, “First Ghibli, now Gemini Nano Banana: Do viral trends hurt more than help?”, September 2025

- Vidico, “20+ Interesting Short Form Video Trends & Statistics (2025)”, August 2025

- Content Whale, “Short-Form Video Strategy That Actually Works in 2025”, August 2025

- Sify, “AI Taken for Granted: Has the World Reached the Point of AI Fatigue?”, January 2025

- Qualtrics, “Consumer sentiment towards AI evolves, 2025”, September 2025

- PhoneArena, “Global Pixel sales exploded in H1 2025”, September 2025

- Accio, “Google Pixel Market Share Trends in 2025”, September 2025

- HDK, “How can you measure value in arts and culture marketing?”, January 2025