On Tuesday, OpenAI launched Prism as a free AI workspace for scientists. Within hours, the marketing world collectively shrugged.

“Cool product,” they said dismissively. “Not for my stack,” came the refrain.

Yet that reaction is precisely why you should pay attention. Because OpenAI just showed their hand on a strategy that will reshape how every vertical AI tool gets built, priced, and distributed over the next three years. Moreover, if you’re treating AI as merely a marketing feature rather than a fundamental shift in how work gets done, you’re about to get out-manoeuvred.

Let’s dissect what Prism actually reveals—and what it means for your business.

The Vertical Takeover Is Here

For two years, we’ve watched OpenAI play the “general platform” game relentlessly. ChatGPT. ChatGPT Plus. ChatGPT Enterprise. Certainly, they’re useful and powerful, but ultimately commoditising. Meanwhile, Slack, Notion, and every SaaS vendor on earth now has a “ChatGPT integration.” Notably, you can build half your workflow with GPT-4. However, you can also build it with Gemini, Anthropic Claude, or open-source models. Inevitably, the differentiation evaporates.

So OpenAI changed course strategically.

Rather than competing in “general AI,” they’re now building what researchers call “verticalized workspaces”—AI tools built specifically for how professionals in one industry actually work. Not ChatGPT pretending to be a scientist. Instead, they’re creating an AI workspace where scientists live, think, and collaborate natively.

Why Vertical Tools Win

Crucially, this mirrors what happened with coding tools last year. Notably, Cursor and Windsurf didn’t succeed because they’re “smarter” than ChatGPT—rather, they won because they embedded AI directly into the IDE, the environment where developers spend eight hours daily. Effectively, you didn’t open ChatGPT to code. Instead, AI came to you.

Prism follows this exact pattern methodically. Essentially, scientists don’t leave their workflow to chat with a bot. Rather, they stay in their LaTeX document while the AI enhances it from within. Critically, this shift matters enormously: 2026 will be for AI and science what 2025 was for AI and software engineering, as Kevin Weil, VP of OpenAI for Science, explicitly told reporters.

“This isn’t about being smarter than ChatGPT. It’s about embedding AI where the work actually happens.”

The Free-Tier Acquisition Trap

Why Free Isn’t Generous

Here’s the move that should concern every SaaS founder: Prism is completely free.

Not “freemium.” Not “limited free tier.” Rather, it offers unlimited projects, unlimited collaborators, and no seat limits whatsoever. Essentially, anyone with a ChatGPT account can access it immediately. Superficially, this looks generous—democratising scientific tools and spreading the wealth. However, beneath the surface lies a calculated acquisition engine that OpenAI can afford because they have approximately $100 billion in infrastructure debt to justify.

The Math Behind the Strategy

Consider the market dynamics carefully now. Overleaf, the market leader, has 10 million users and monetises through paid plans at roughly £12–40 monthly (approximately ₹1,000–3,300 or $14–48 USD). Meanwhile, their estimated annual revenue sits north of £50 million (₹460 crore or $63 million USD), probably closer to £100 million (₹920 crore or $126 million USD) if you believe investor claims seriously.

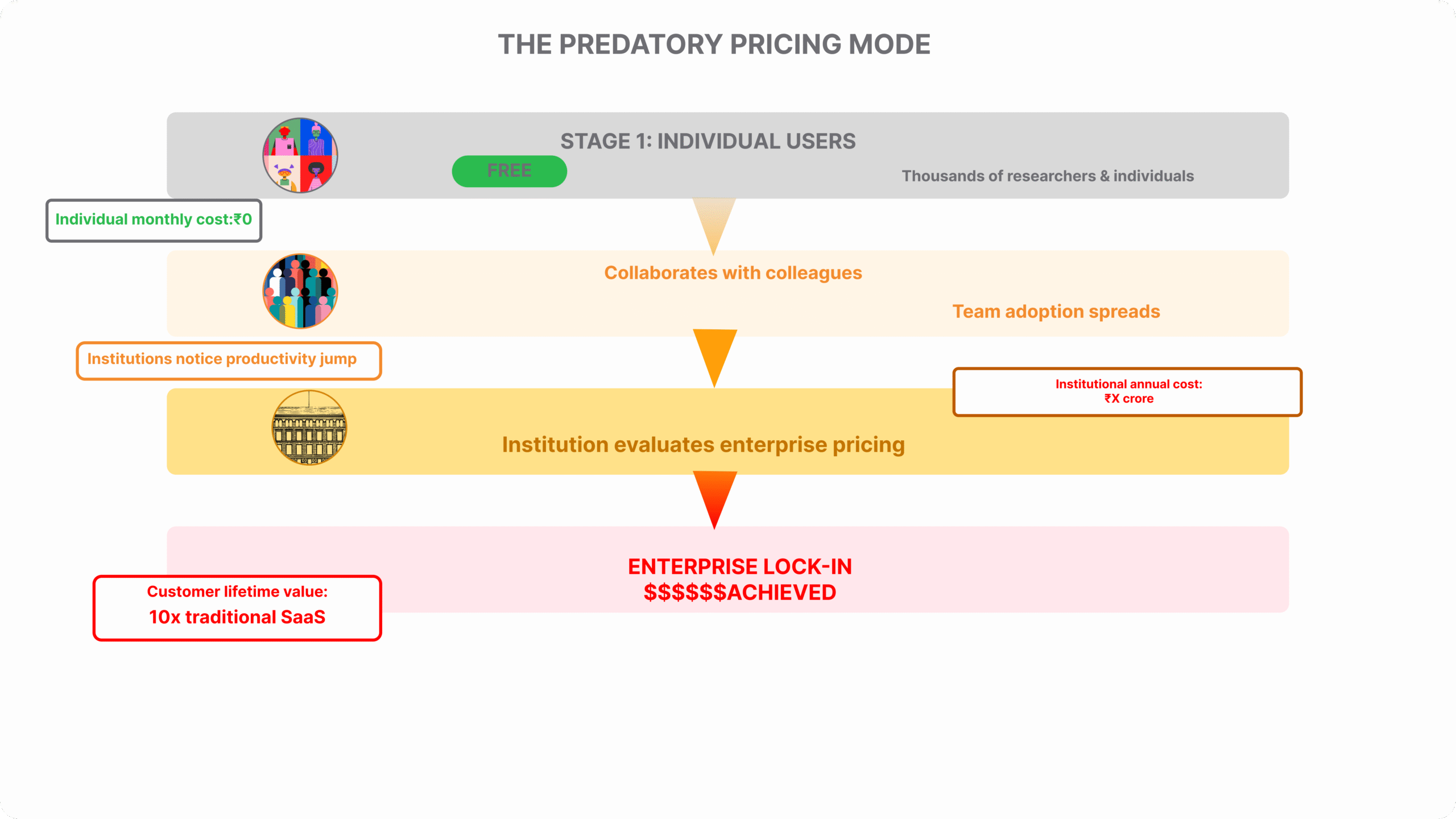

Interestingly, OpenAI’s free tier doesn’t chase that revenue target at all. Why? Because they’re not monetising individual scientists. Instead, they’re trying to lock in institutions strategically. Here’s exactly how it works in practice:

First, you (a researcher) use Prism for free voluntarily. Subsequently, you collaborate with colleagues naturally. Eventually, your university’s research office notices your team’s productivity jump unmistakably. Then your institution faces a critical choice: pay OpenAI’s enterprise rates for institutional Prism access, or watch researchers maintain fragmented workflows across platforms.

“OpenAI isn’t trying to monetise individual users. They’re trying to lock in institutions—and they can afford to play the long game.”

That’s bottom-up enterprise motion at its finest. Notably, OpenAI already has a proven template—ChatGPT Enterprise hit $800 million in annual recurring revenue (₹6,600 crore or €750 million) through product-led growth alone, with minimal enterprise sales overhead.

Why Competitors Can’t Match This

The genius only works when you have massive balance sheet strength available. Because OpenAI can subsidise Prism indefinitely while it justifies their compute infrastructure spend strategically. Each researcher using Prism generates sustained, high-value compute demand—long documents, extended reasoning, persistent context continuously. Effectively, that transforms infrastructure from cost centre into competitive moat.

Smaller AI vendors simply can’t replicate this model economically. They either charge from day one (lowering adoption rates) or burn cash (unsustainable long-term). Meanwhile, OpenAI writes it off strategically as demand generation for their data centres.

What Marketers Are Missing

The Obvious Take (Wrong)

“Prism isn’t built for marketers. We need ChatGPT,” they say. True.

“This doesn’t affect my business,” they assume falsely. False.

The Dangerous Reality

Here’s what matters most: OpenAI isn’t stopping at science alone. Sarah Friar, their CFO, published a strategic roadmap in January naming the next verticals explicitly: healthcare, financial services, legal, and engineering.

Healthcare comes first logically. Clearly, doctors and pharmacists deal with identical workflow friction patterns. They publish research routinely. They analyse data constantly. They synthesise complex information daily. Essentially, these processes happen inside specialist vertical tools now (Epic for EHRs, Salesforce for practice management). Inevitably, OpenAI will build AI directly into those workflows.

When they do, the playbook repeats identically. Free tier for practitioners initially. Viral adoption through hospital networks subsequently. Enterprise pricing when incumbents can’t compete fundamentally.

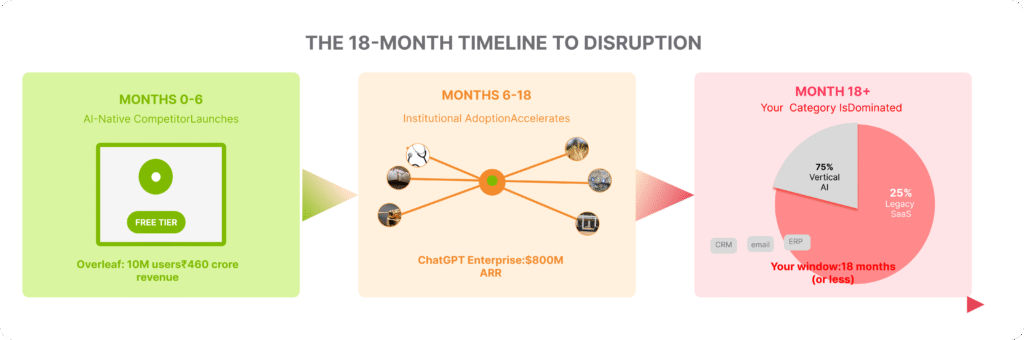

“Within six months, there will be an AI-native vertical tool competing directly with your core platform. Within 18 months, it will dominate.”

Your Industry Is Next

For marketers, the transformation is happening right now. This isn’t about what will happen—it’s unfolding this quarter. Salesforce is scrambling to embed AI into CRM workflows because customers are demanding it. Your email platform competitors are racing to add AI-native capabilities or face obsolescence. Moreover, your analytics, content management, and design software—they’re all being verticalised simultaneously, becoming AI-native as we speak, and differentiation is collapsing in real time.

Your competitive advantage was “using AI better than competitors.” That strategy is dead. Rather, survival depends on integrating AI-native tools into your platform architecture before OpenAI builds a direct competitor in your vertical. Because the commodity layer isn’t settling in some distant future—it’s settling this quarter. The companies adapting their product strategy now, whilst you’re reading this sentence, will own the market. Those waiting six months will be fighting for survival against vendors with better balance sheets and faster execution.

The Uncomfortable Truth About Free

Breaking Down the Predatory Model

Prism being free should terrify existing LaTeX editors and reference management vendors profoundly.

Yet it should also make you ask uncomfortable questions about your own business model seriously. If you’re selling software to knowledge workers, and a company with $100 billion in infrastructure capacity competes in your space, your pricing model becomes hostage to their balance sheet rather than your unit economics strategically.

This differs fundamentally from traditional competition significantly. Traditional competition says: “We’ll build a better product at a lower price.” That’s sustainable certainly. However, what OpenAI is doing says something else entirely: “We’ll subsidise your category until you’re irrelevant, because owning the workflow layer is worth more than the revenue from the surface layer.” That’s predatory arguably. Probably not illegal technically. But it’s fundamentally different strategically.

The SaaS Reckoning

This dynamic applies to every SaaS category eventually. Because the lesson for marketers is stark fundamentally: If your business depends on selling tools to professionals, you’re about to compete against companies measuring success in “workflow share” rather than “revenue per seat”. Your pricing power erodes rapidly. Your distribution advantage evaporates completely.

“Unlike the last 10 years of tech competition, there’s no clever positioning or marketing that fixes this. It’s infrastructure, data, and workflow lock-in.”

The Data Moat Nobody’s Talking About

What OpenAI Is Actually Collecting

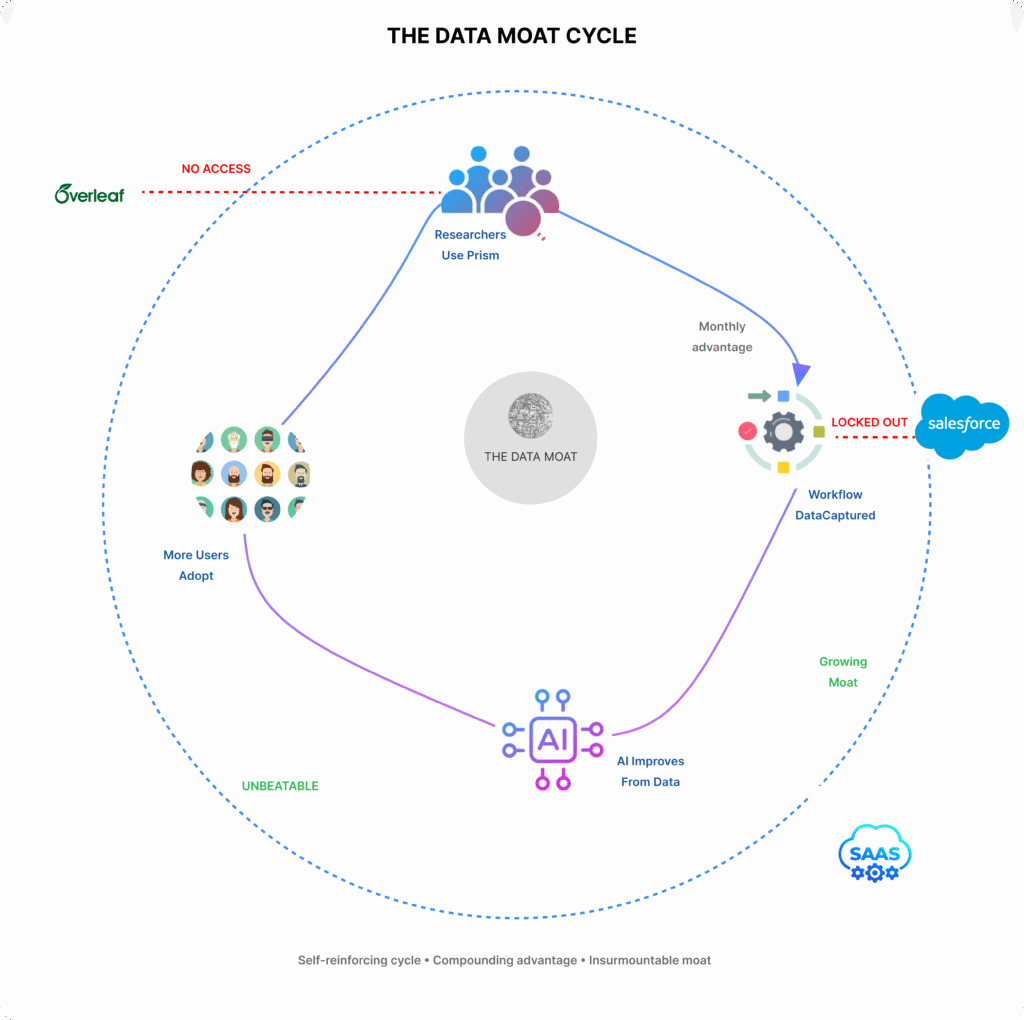

Here’s what OpenAI’s marketing materials don’t mention transparently: Every time a researcher uses Prism, OpenAI captures detailed workflow data systematically.

Research questions asked frequently. Argument structures used consistently. Citation choices made deliberately. Time spent on sections measured precisely. Revisions made iteratively. Collaboration patterns observed constantly. That’s not metadata trivially. Rather, it’s scientific thought patterns encoded at scale systematically.

For training models, that’s invaluable strategically. Because for identifying emerging research trends, it’s a crystal ball essentially. For predicting which papers matter, which labs innovate, which institutions push boundaries—it’s competitive intelligence worth billions genuinely.

The Compounding Advantage

Overleaf has that workflow data too certainly. Yet Overleaf didn’t build an AI-native platform fundamentally. OpenAI did strategically. Because once you’re capturing research workflows at scale, you improve the AI experience inevitably, which drives adoption naturally, which generates more data exponentially.

That’s a moat strengthening monthly predictably. For marketers, the parallel is obvious unmistakably. If you’re using AI tools from vendors who don’t own the data layer, you’re leasing intelligence from someone else’s moat fundamentally. The vendor capturing your workflow data—customer interactions, messaging effectiveness, brand conversation evolution—becomes increasingly valuable to your entire industry inevitably.

Consequently, owning your data infrastructure stops being optional quickly. It becomes existential fundamentally.

“The ‘free’ pricing might be less about generosity and more about acquiring a training data moat that competitors can’t replicate.”

Why This Matters Right Now

The Convergence Point

OpenAI’s timing isn’t accidental strategically. Because Sarah Friar explicitly stated 2026 is “the year of practical adoption”—moving AI from demos into embedded workflows deliberately.

Simultaneously, they’re rolling out advertising in ChatGPT aggressively. They’re launching Prism strategically. They’re building regional partnerships (SoftBank in Japan) deliberately. They’re preparing enterprise education versions systematically. All of this signals upmarket movement across everything.

This company has finished proving their model works empirically. Now they’re executing at industrial scale relentlessly.

Your Timeline

For your industry, here’s the breakdown clearly: Within six months, an AI-native vertical tool competes directly with your core platform inevitably. Within 18 months, that tool dominates your enterprise segment completely. Within three years, you’re competing against it or acquired necessarily.

The companies surviving are those realising the AI layer isn’t a feature you bolt on fundamentally. Because it’s the foundation your business sits on completely. Your competitive advantage isn’t “how do we use AI better than competitors anymore” but “how do we build systems where AI drives our core value proposition?”

Prism tells you exactly how to think about that strategically. It’s not smarter than ChatGPT technically. It’s simply embedded where the work actually happens necessarily.

What You Should Do About It

Step 1: Reframe Your Thinking

Stop thinking about AI as a productivity multiplier immediately. It’s not technically. Because rather, it’s fundamental restructuring of how work organises completely.

Step 2: Audit Your Platform

Conduct a thorough audit of your core platform carefully now. Where do customers spend time actively? Where do they decide critically? Where could an embedded AI agent replace 60% of your UI?

Step 3: Invest in Data Infrastructure

Get aggressive about data deliberately now. If you don’t own your platform’s workflow data, you’re vulnerable strategically. Invest now, whilst you can practically.

“Companies that own the vertical layer own the relationship with users. They own the data. They own the switching costs.”

Step 4: Don’t Compete on AI Capability

Don’t compete on raw AI capability directly. You’ll lose inevitably. OpenAI has more compute, data, and engineering talent resources. Instead, compete on understanding customer workflows better than anyone else fundamentally.

Step 5: Consider Your Exit Strategy

Think carefully about partnerships or acquisition opportunities. If you’re a category leader in a vertical OpenAI will target, your window narrows inevitably. Selling now, at peak market power, might beat hoping you adapt faster.

Step 6: Build for Integration

Build for integration, not replacement fundamentally. Once Prism-like tools exist in your vertical, your software needs working alongside them necessarily. The monolithic platform era ends definitively.

The Pattern Nobody’s Watching

The Consolidation Is Coming

Here’s what’s easy to miss fundamentally: This isn’t just OpenAI. Because rather, it’s what happens combining three things systematically: huge capital reserves, AI capability at scale, and the ability to absorb infrastructure costs that bankrupt competitors completely.

Multiply that across 20 categories in three years, and you get fundamental software stack consolidation inevitably. General tools (ChatGPT, Claude, etc.) become utilities—cheap, available, table stakes increasingly. Value concentrates in vertical-specific implementations deeply embedded in actual work necessarily.

Companies owning the vertical layer own user relationships completely. They own the data strategically. They own switching costs effectively. They own distribution directly.

Who’s Executing This Strategy

OpenAI isn’t the only company with that playbook strategically. Because Google has it certainly. Microsoft has it (partially). Amazon has it inevitably. Meta has it too.

Yet OpenAI executes it first aggressively, most aggressively, and across the most valuable categories ultimately.

The Bottom Line

What Prism Actually Signals

Prism launches, and the marketing world yawns because it’s not built for marketers obviously.

They’re wrong to ignore it fundamentally. Prism tells you the era of general-purpose AI tools competing as features is ending definitively. The future belongs to companies embedding AI inside workflows, capturing flowing data, and using it to build unbeatable switching costs strategically.

That’s not a Prism problem trivially. That’s your problem fundamentally.

Your 18-Month Window

If your software isn’t built on that principle fundamentally, if your data infrastructure isn’t ready to capture and learn from workflow patterns, if you’re thinking AI as “something we use” rather than “our foundation”—you’ve got 18 months to change dramatically.

After that, you’re competing against vendors whose balance sheets can subsidise your category into irrelevance inevitably. Because unlike the last 10 years, there’s no clever positioning or marketing that fixes this ultimately. It’s infrastructure, data, and workflow lock-in fundamentally.

The Real Story

Prism isn’t the story literally. What Prism signals about the future is the story ultimately. And that future arrives faster than you think inevitably.

“Prism isn’t the story. The story is what Prism signals about the future. And that future arrives faster than you think.”

Related Reading on Your Site

- Claude Sonnet 4.5 Marketing Analysis: Why Anthropic’s Launch Strategy Works — How competitors position against OpenAI’s vertical expansion

- OpenAI Marketing Archives — Deeper analysis of OpenAI’s evolving strategy

- AI Marketing Best Practices — Framework for competing in the AI era

- Brand Strategy Errors — Why generalised positioning fails now

- Tech Brand Strategy — Strategic frameworks for technology companies

Key Sources Cited

- OpenAI Prism launch announcement

- Kevin Weil LinkedIn announcement

- TechCrunch analysis of Prism launch

- Sarah Friar 2026 strategy roadmap

- Constellation Research: Practical adoption strategy

- OpenAI enterprise strategy and ARR

- Aragon Research: Vertical workspace strategy

- Overleaf market position

- OpenAI infrastructure investment

- McKinsey: AI strategy and implementation

- HBR: AI as competitive infrastructure

- The Verge: Sarah Friar practical adoption

- The Verge: Cursor and coding AI tools