The “Top Dogs” immersive series isn’t just a cute documentary—it’s a billion-dollar bet on whether content can rescue dying hardware.

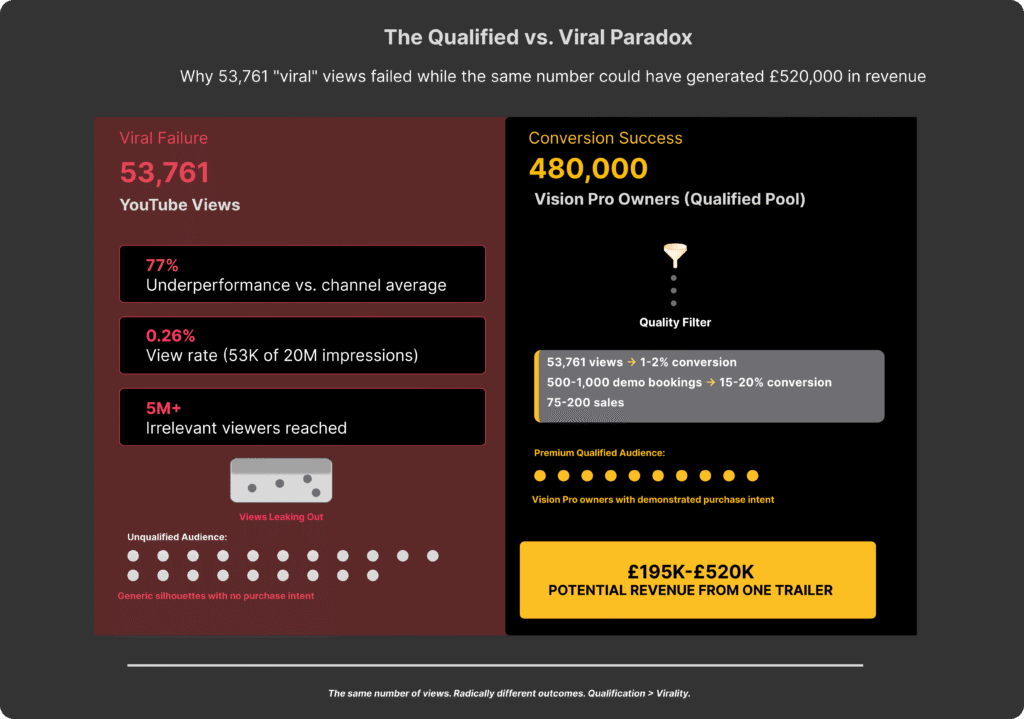

When Apple released the trailer for “Top Dogs” on 22 January 2026, the response was deafening silence. Just 53,761 YouTube views in four days—a 77% underperformance against Apple’s channel average of 230,000 views per video. For a company that routinely generates millions of views announcing new iPhone colours, this should trigger alarm bells.

Yet here’s the counterintuitive reality: that anaemic trailer performance might be exactly what Apple’s marketing strategy requires. If you’re a marketer wrestling with premium product positioning, exclusive content economics, or the death spiral of performance marketing metrics, what’s happening with Vision Pro and “Top Dogs” should fundamentally reshape how you think about content-led conversion funnels.

Apple isn’t marketing to YouTube viewers. Instead, they’re targeting the 480,000 people globally who’ve already spent £2,600 on Vision Pro headsets—and more importantly, the tiny cohort who might plausibly spend that sum in 2026. The YouTube trailer exists primarily to give those prospects something to search for when booking their mandatory 25-minute in-store demo appointments. Essentially, it’s content as pre-qualification mechanism, not awareness driver.

This inversion of traditional marketing logic—terrible reach metrics signalling strategic success—illuminates a broader shift happening across premium marketing in 2026. As performance marketing reaches saturation and customer acquisition costs spiral upward, a countermovement is emerging: radically narrowing addressable audiences, creating genuinely exclusive experiences, and accepting that viral metrics and revenue metrics increasingly diverge.

Let’s examine why Apple is spending an estimated £4 million per episode on a dog show documentary almost nobody can watch—and what it reveals about where premium content marketing is heading.

The Death of Reach as Primary KPI

Why Low View Counts Might Signal Success

Traditional marketing thinking suggests 53,761 YouTube views for a major Apple content launch represents catastrophic failure. Apply conventional metrics and “Top Dogs” looks like a marketing disaster: 0.26% view rate against channel subscribers, missing industry benchmarks for channels of Apple’s scale by 95%+.

However, those benchmarks assume the goal is maximising eyeballs. What if the goal is maximising qualified intent instead?

The Mathematics of Ultra-Premium Targeting

Consider the conversion mathematics. Vision Pro requires prospects to:

- Own an iPhone (for face scanning to determine headset fit)

- Live within reasonable distance of an Apple Store (270 US locations)

- Have discretionary income sufficient to justify £2,600 on entertainment hardware

- Possess sufficient technological sophistication to understand spatial computing value proposition

- Schedule and attend a 25-30 minute appointment during retail hours

Globally, perhaps 10-15 million people meet all five criteria—approximately 0.1% of the 8 billion human population. Of those, maybe 20-30% have any awareness or interest in VR/AR technology. As a result, your actual addressable audience: 2-4 million people worldwide.

Suddenly, 53,761 YouTube views in four days looks different. Even with conservative conversion rates of 1-2% from view to demo scheduling, that’s 500-1,000 qualified appointments. Furthermore, if 15-20% of demos convert to purchases—and Apple Store demos likely convert higher than typical B2B software demos given the experiential nature—you’ve generated 75-200 sales from that single trailer.

At £2,600 average selling price, that’s £195,000-£520,000 in revenue attributable to one 35-second video. Suddenly the economics look sustainable.

Reach as Vanity Metric

This reframes reach as vanity metric when selling ultra-premium products. Mass awareness without qualified intent creates support burden (unqualified questions flooding retail channels), brand confusion (mainstream audiences viewing product as “failed” due to lack of peers using it), and wasted media spend.

Better to reach 50,000 highly qualified prospects than 5 million curiosity-seekers.

This principle applies across premium positioning—something I explored in depth when analysing Apple’s iPhone 17 Pro “Come Rain or Come Shine” campaign, where durability messaging struggled against AI-focused competitors.

Content as Conversion Infrastructure

Beyond Traditional Marketing Content

Here’s where “Top Dogs” gets genuinely interesting for marketers: it’s not actually marketing content. Rather, it functions as conversion infrastructure.

Apple’s Vision Pro sales model depends almost entirely on in-store demo experiences. You cannot purchase Vision Pro online without first completing face scanning via iPhone app and demo attendance. This isn’t optional—it’s mandatory conversion funnel architecture.

What Demo Content Requires

The 25-30 minute demo requires substantial content inventory. Specifically, store associates need:

- Multiple content categories (music, sports, nature, lifestyle) to match prospect interests

- Varying intensity levels (calm experiences for VR newcomers vs. dynamic content for enthusiasts)

- Family-friendly options for parents bringing children

- Quick-impact “wow moments” front-loaded in first 5 minutes to overcome scepticism

- Sufficient variety that repeat visitors (partners/friends wanting second opinions) see new content

Universal Accessibility: The Dog Content Advantage

“Top Dogs” slots into this infrastructure as universally accessible content. Unlike previous Vision Pro immersive releases—Alicia Keys concerts (requires music taste alignment), NBA games (requires sports interest), extreme sports series “Elevated” (requires thrill-seeking personality)—dogs competing at Crufts requires zero prerequisite knowledge or cultural affinity.

Everyone understands dogs. Similarly, everyone can appreciate athletic ability. Most importantly, everyone recognises competition tension. Consequently, the content works equally well for tech executives, retirees, parents with young children—all key Vision Pro prospect demographics.

The Production Economics Equation

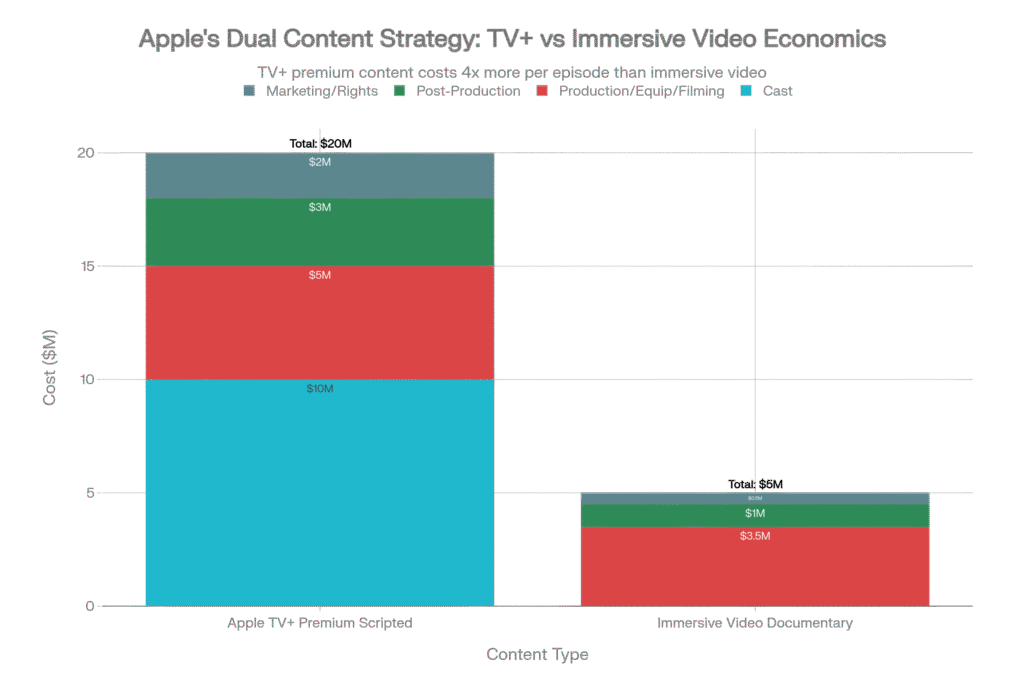

The production economics reinforce this strategy. An estimated £4 million per episode for “Top Dogs” seems expensive until compared with Apple TV+ flagship series commanding £15-20 million per episode. More critically, that immersive content delivers value impossible to achieve through traditional marketing spend:

A £4 million immersive documentary provides:

- Evergreen demo content usable for 2-3 years across hundreds of retail locations

- Hardware-exclusive experience impossible to pirate or view on competing platforms

- “Wow moment” showcase demonstrating Vision Pro’s unique capabilities vs. traditional screens

- Word-of-mouth catalyst when owners show friends/family

Amortised across 500,000-1,000,000 eventual viewers (current 480,000 installed base growing slowly), that’s £4-8 cost per view—expensive by YouTube CPM standards (£2-10) but justifiable for conversion-critical content. Additionally, in a demo environment where prospect’s purchase intent is already qualified through appointment scheduling behaviour, the economics make even more sense.

“At £4-8 cost per view, immersive content becomes justifiable for conversion-critical environments where prospect’s purchase intent is already qualified through appointment scheduling behaviour.”

Inverting Traditional Performance Marketing

Compare this with traditional performance marketing: Facebook/Instagram ads for luxury products typically run £20-100+ cost per qualified lead, with 2-5% conversion rates to purchase.

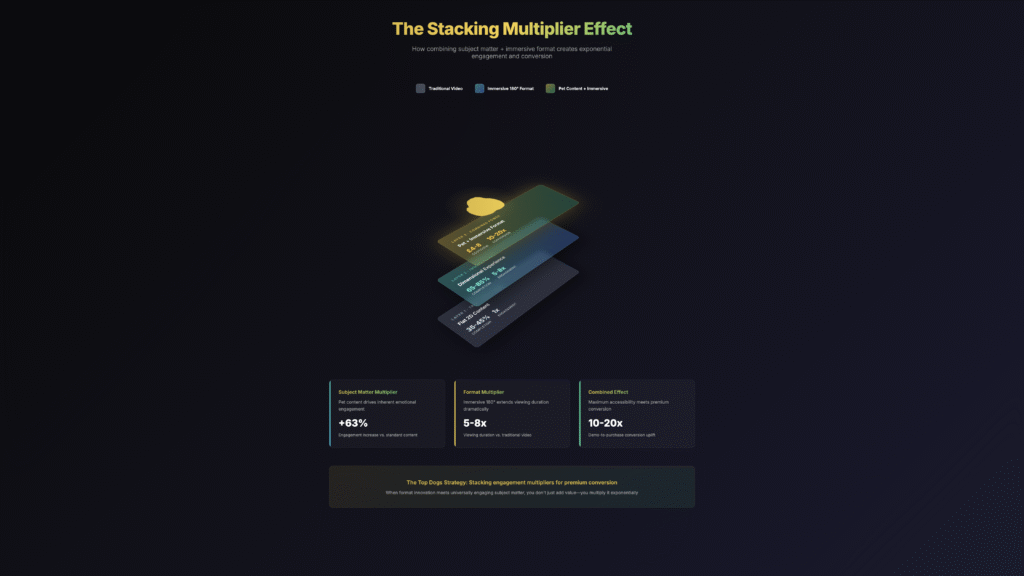

In contrast, Vision Pro’s demo-first model inverts this—higher upfront barrier (scheduling appointment) selects for serious intent, thereby yielding conversion rates potentially 10-20x higher than cold traffic.

Vision Pro’s demo-first model inverts traditional performance marketing—higher upfront barrier selects for serious intent, yielding conversion rates potentially 10-20x higher than cold traffic.

The Engagement Format Multiplier Nobody’s Discussing

Beyond the Metaverse Hype

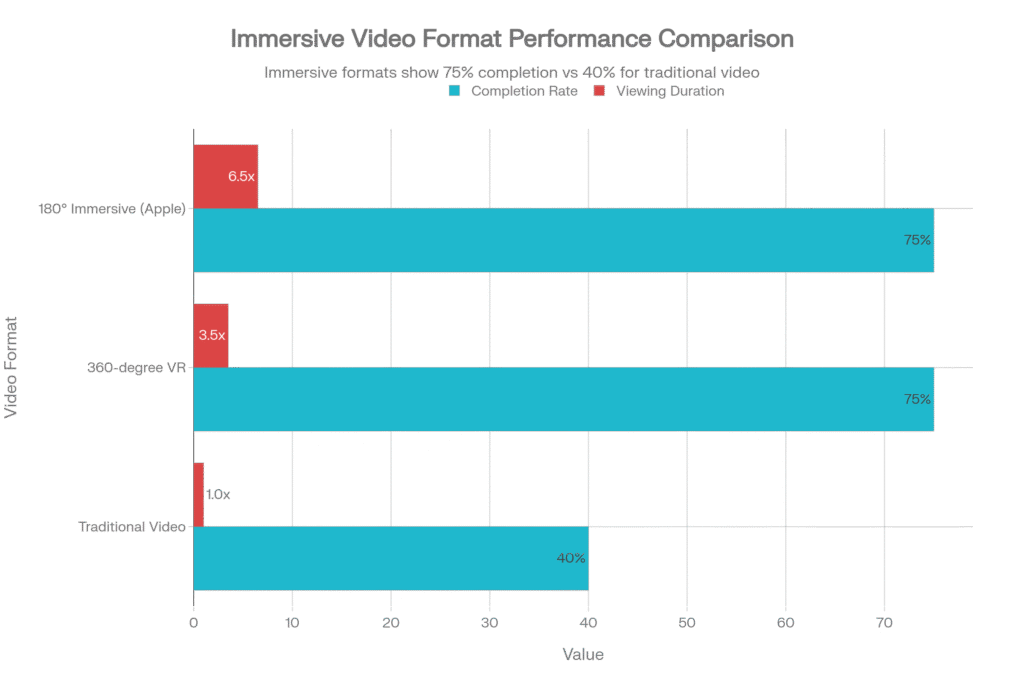

Marketing conversations about immersive/VR content typically focus on novelty factor: “it’s the future,” “Web3 convergence,” “metaverse positioning.” However, this misses the empirical engagement data that should reshape content strategy decisions.

Research across VR platforms consistently shows immersive 180-degree video formats achieve 5-8x longer viewing duration than traditional video, with 65-85% completion rates vs. 35-45% for standard content. This isn’t marginal improvement—it’s order-of-magnitude difference in attention capture.

Stacking Engagement Multipliers

Combine that format advantage with pet content’s proven performance multiplier (63% higher engagement vs. average posts, 89% more comments).

“Top Dogs” effectively stacks two engagement amplifiers: subject matter (dogs) × delivery format (immersive) = maximum accessibility for demonstrating capabilities.

For marketers, this suggests radically underexplored opportunity. Currently, VR/AR content creation focuses primarily on gaming (Meta’s strategy) or productivity applications (enterprise AR). Meanwhile, passive entertainment—the lowest-friction content consumption mode—remains dramatically underserved despite demonstrating superior engagement metrics.

The Fragmentation Challenge Creates First-Mover Advantage

The business model challenge stems from hardware distribution. Creating immersive content today means addressing a fragmented, small market: 480,000 Vision Pro owners, ~20 million Meta Quest users, ~5 million PSVR2 users.

As a result, total addressable audience: ~25 million headset owners globally, with minimal overlap in content compatibility due to proprietary formats and platform restrictions.

Yet this fragmentation creates first-mover advantages for brands willing to invest now. National Geographic, BBC Earth, Red Bull, and similar premium content brands partnering with Apple on immersive productions establish positioning as spatial computing pioneers—building technical expertise, creator relationships, and content libraries before mainstream adoption arrives.

When (if?) spatial computing reaches 100-200 million installed base by 2028-2030, brands that spent 2024-2026 building immersive content competency will dominate. Competitors, by contrast, will scramble to retrofit traditional content strategies for 180-degree stereoscopic formats requiring fundamentally different cinematography, editing, and distribution workflows.

Why Premium Brands Should Care About Vision Pro’s Failure

The Scale of the “Failure”

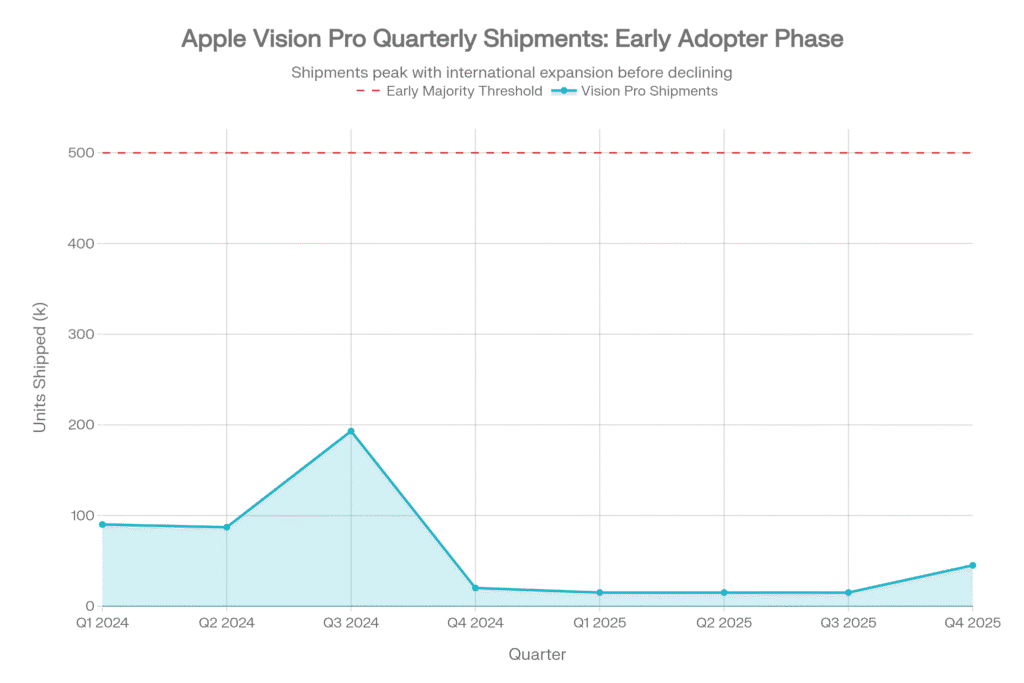

Vision Pro is failing by conventional product success metrics. Approximately 480,000 cumulative sales through 2025, declining quarterly shipments (from 193,000 in Q3 2024 to 45,000 in Q4 2025), and Apple implementing 95% production cuts in January 2026.

The device remains trapped in early adopter phase at less than 4% penetration of the 13.5% early adopter segment, nowhere near the 34% early majority threshold required for mainstream traction.

Nevertheless, Vision Pro’s struggles illuminate crucial lessons for premium brand positioning:

Lesson 1: Demo Economics Trump Media Economics

Vision Pro’s mandatory demo model—requiring 25-30 minute appointments, face scanning, prescription assessment, and calibration—creates severe scalability constraints but delivers conversion rates likely 10-20x higher than digital advertising funnels.

Maximum throughput: approximately 4,000-5,400 daily demos across 270 US Apple Stores, yielding perhaps 800-1,000 daily sales at 20% conversion.

Why the Model Works Despite Scale Limitations

This model cannot scale to millions of units annually. However, it doesn’t need to. At £2,600 price point, 400,000 annual sales generates £1.04 billion revenue—small by Apple standards (£300+ billion annual revenue) but substantial absolute terms, with gross margins likely exceeding 40%.

Premium brands wrestling with rising CAC and declining ROAS should consider: what if we optimised for demo conversion instead of ad reach? Consequently, what would change about content strategy, retail experience, qualification criteria?

This connects directly to broader tensions in Apple’s marketing approach that I’ve explored previously—from accessibility advertising that balances sincerity with spectacle to the smartphone marketing melee of September 2025 where every brand scrambled for relevance against Apple’s product cycle.

Lesson 2: Exclusive Content Creates Durable Moats

“Top Dogs” exists exclusively on Vision Pro. You cannot watch it on Meta Quest, PSVR2, or traditional screens. This exclusivity—typically criticised as limiting addressable audience—actually constitutes strategic asset for premium positioning.

When hardware costs £2,600, exclusive content doesn’t just justify purchase price—it creates ownership validation.

Vision Pro buyers aren’t purchasing a device; rather, they’re purchasing access to experiences unavailable elsewhere.

Accordingly, Apple invests £200-300 million annually in immersive video production not to maximise view counts, but to maintain perception that Vision Pro offers genuinely differentiated value vs. £400 Meta Quest 3.

Why Scarcity Maintains Premium

Luxury brands understand this intuitively: Hermès doesn’t maximise distribution because scarcity maintains brand premium. Exclusivity isn’t bug—it’s feature. Nevertheless, many “premium” brands still optimise content for maximum reach rather than exclusive value for existing customers.

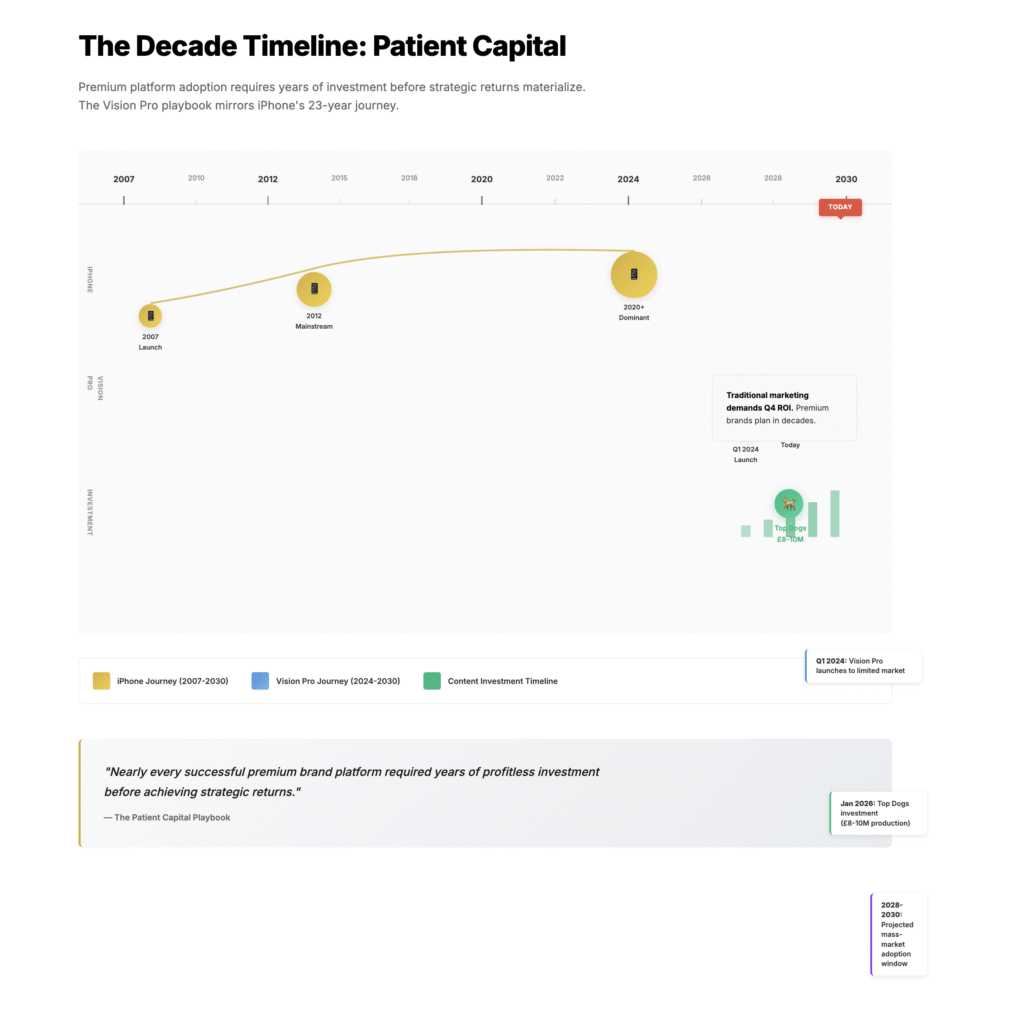

Lesson 3: Patient Capital and Decade Timelines

Vision Pro launched February 2024. By January 2026, media coverage declares it “failing”. Yet Apple’s product cycles operate on decade timescales: iPhone (2007 launch, mainstream 2012), Apple Watch (2015 launch, category leader 2019), AirPods (2016 launch, dominant 2020).

The “Top Dogs” investment—£8-10 million for two-episode series—represents patient capital deployment. Apple isn’t expecting immersive content to drive Q1 2026 sales targets. Rather, they’re building content library infrastructure for 2027-2030 when (if?) second- or third-generation Vision devices reach accessible price points (£1,000-1,500) and installed base grows to 2-5 million users.

The Patience Premium Brands Require

Most marketing organisations cannot sustain this patience. Quarterly planning cycles and annual budget resets penalise strategies requiring 3-5 year payback periods.

Nevertheless, nearly every successful premium brand platform—Apple ecosystem, Amazon Prime, Netflix originals—required years of profitless investment before achieving strategic returns.

The Uncomfortable Truth About Niche Content Strategy

Why Niche Equals Success Here

Here’s the part that makes CMOs uncomfortable: “Top Dogs” succeeds because it’s niche, not despite it.

Marketing orthodoxy pushes toward TAM expansion: “How do we make this appeal to more people?” Yet ultra-premium products require opposite thinking: “How do we make this perfectly suited to our narrow audience whilst actively alienating everyone else?”

Reframing “Weaknesses” as Filtering Mechanisms

Vision Pro faces this tension constantly. Media coverage criticises the device as “too expensive” (£2,600), “too heavy” (600-650 grams), “lacking content” (~3,000 apps vs. 8,500+ on Meta Quest).

All accurate. All irrelevant to the specific audience Apple targets: high-income professionals (£120,000+ household income), early adopter technophiles, enterprise use cases.

For that narrow cohort, Vision Pro’s premium pricing signals quality. Weight becomes acceptable tradeoff for visual fidelity, and curated content library (vs. Meta’s open platform chaos) represents feature not bug. Importantly, the device’s “weaknesses” constitute filtering mechanisms that pre-qualify prospects and reduce support burden from unsuitable customers.

Vision Pro’s ‘weaknesses’ constitute filtering mechanisms that pre-qualify prospects and reduce support burden from unsuitable customers.

Leaning Into Specificity

“Top Dogs” follows identical logic. A two-part documentary about Crufts dog show—founded 1891, attracting 28,000 competing dogs and 160,000 human attendees annually—targets niche within niche: dog enthusiasts AND spatial computing early adopters AND individuals willing to spend £2,600 on entertainment hardware.

Conventional content strategy would broaden appeal: maybe make it about all pets, or focus on universal themes like competition and perseverance. Instead, Apple leans into specificity: actual Crufts footage, emphasis on unpredictability (“the giant killer”), authentic dog show culture.

Tribal Signalling and Word-of-Mouth

This specificity creates tribal signalling. Vision Pro owners who happen to love dogs will watch “Top Dogs,” find it delightfully specific to their interests, and share with dog-loving friends as proof Vision Pro “gets it.”

That word-of-mouth—from existing customer to culturally similar prospect—converts infinitely better than generic mass marketing.

The broader marketing lesson: niche content at premium price points outperforms broad content at volume pricing. Yet most organisations still optimise for reach over resonance, building content for “everyone” that connects with no one particularly strongly.

What Marketers Should Actually Do With This

Strategic Shift #1: Narrow Your Targeting

Stop trying to appeal to your entire TAM. Instead, create hyper-specific content for your best 5-10% of customers—the ones spending 2-3x category average. Let that content actively alienate everyone else. Track conversion and LTV metrics, not reach and engagement.

Strategic Shift #2: Content as Infrastructure

Build content inventory that supports high-touch sales processes (demos, consultations, trials) rather than top-of-funnel awareness. Consequently, measure content success by conversion lift in qualified pipelines, not by view counts or social shares.

Strategic Shift #3: Accept Premium CAC

If you’re spending £100-300 to acquire customers worth £2,000-10,000 LTV, that’s sustainable even though efficiency metrics look terrible vs. volume brands spending £5-20 per customer worth £50-200. Premium brands require premium acquisition investment.

Strategic Shift #4: Proprietary Formats

For Apple, that’s immersive 180-degree video. For your brand, it might be: interactive product configurators, virtual consultation tools, exclusive community platforms, or proprietary content formats. Build moats through format ownership, not just content quality.

Strategic Shift #5: Patient Capital

Stop expecting content ROI in 90 days. Instead, build content libraries with 2-5 year useful life. Amortise production costs across hundreds of conversion touchpoints over multiple years. Treat content as capital expenditure, not operating expense.

The Larger Pattern This Reveals

The Return to Brand Building Fundamentals

“Top Dogs” represents microcosm of broader shift happening across premium marketing in 2026: the death of performance marketing orthodoxy and return to brand-building fundamentals adapted for digital infrastructure.

For a decade (2014-2024), marketing optimised relentlessly for measurable performance: CAC, ROAS, conversion rates, attribution modelling. This worked brilliantly for volume businesses selling £20-200 products where thousands of daily conversions provide statistical confidence in optimisation.

Where Performance Marketing Breaks Down

It works terribly for £2,600 hardware with mandatory in-store demos, 60-90 day consideration cycles, and annual sales targets of 300,000-500,000 units.

You cannot A/B test your way to premium brand positioning. Similarly, you cannot performance-market luxury goods.

The metrics that matter—brand perception, consideration intent, ownership validation—resist easy quantification.

The Radical Response

So Apple does something radical: it ignores YouTube view counts, accepts anaemic trailer performance, invests £8-10 million in dog show content most people will never watch, and measures success by whether existing customers feel validated in their £2,600 purchase decision and whether prospects booking demos convert at 15-20% rates.

This looks like failure through performance marketing lens. However, it’s actually sophisticated brand building adapted for digital-first, content-driven conversion infrastructure.

The question for marketers: are you optimising for the metrics that matter to your business model, or the metrics that are easy to measure? Because increasingly, those are different things.

Sources & Further Reading

Related Articles on This Site:

- Apple’s iPhone 17 Pro Marketing: A Critical Campaign Analysis

- The Shaking Frame: Apple’s Accessibility Advertising Between Sincerity and Spectacle

- The September Siege: When Smartphone Brands Lost Their Collective Sanity in the Marketing Melee

Apple Official Sources:

- Apple Newsroom: Apple previews new immersive films for Apple Vision Pro (September 2025)

- Apple Newsroom: New Apple Immersive Video series and films premiere (July 2024)

Market Analysis & Sales Data:

- Yahoo Finance: Apple cuts Vision Pro production and marketing after weak sales (January 2026)

- MacRumors: Report – Apple Vision Pro is still failing to catch on (January 2026)

- Indian Express: Apple cuts back Vision Pro headset production by 95% (January 2026)

- MacDailyNews: Apple slashes Vision Pro production and marketing due to weak sales (January 2026)

Target Market & Consumer Research:

- UMN DDG: Apple Vision Pro – Target market and early adopters (June 2025)

- AppleInsider: Apple TV+ budgets targeted as Apple trims video costs (July 2024)

- AppleInsider: Apple Vision Pro’s biggest market is enterprise (September 2025)

- Reddit: Apple TV+ spent $20B on original content (November 2024)

Brand Strategy & Ecosystem:

- CDO Times: Apple’s ecosystem strategy – Building loyalty through integration (November 2024)

- Wonkrew: How does Apple promote their products – Marketing strategy (January 2025)

- Marcom: Apple’s marketing – 8 key strategies and famous campaigns (July 2025)

- Dieselhaus: Apple’s walled-garden ecosystem integration (April 2025)

- Techiest: Apple’s walled garden – Fortress or prison? Economic analysis (November 2025)

- Motley Fool: What is Apple’s walled garden? (June 2025)

VR Engagement & Content Performance:

- MM Communications: Video 360 and VR marketing – Immersive content strategy (December 2024)

- Impact.com: How pet influencers drive results beyond pet brands (May 2025)

- Sortlist: Cats and dogs boost your business by 300%

- Reddit: Study – Only 25 percent of U.S. adults have used VR (April 2025)

Technology Adoption Research:

- Clutch: Technology adoption curve – Five stages of adoption (April 2025)

- Omniplex Learning: The 5 stages of the technology adoption curve (September 2024)

Production & Documentary Filmmaking:

- Gidii Advocacy: The documentary timeline – From first idea to finished film (September 2025)

- C-I Studios: Stages of documentary production (February 2025)

- StudioBinder: How to create a documentary shooting schedule (June 2025)

- ShowSight Magazine: Crufts 2025 – The world’s greatest dog festival (April 2025)

- Wikipedia: Crufts

Demo Strategy & Conversion:

- Business Standard: Apple to host 25-min in-store demo sessions with Vision Pro buyers (January 2024)

- MacRumors: Apple Vision Pro demos can be reserved starting Saturday (February 2024)

- Road to VR: How to reserve an Apple Vision Pro demo online (February 2024)

- Erick Kim Photography: To increase Apple Vision Pro sales, expand your universe (January 2026)

YouTube Analytics & Performance:

- HypeAuditor: Apple YouTube channel statistics and analytics

- VidIQ: Apple YouTube channel stats (January 2026)

- HubSpot: YouTube creator performance benchmarks report (PDF)

B2B Marketing & Conversion Metrics:

- Howdygo: 8 examples to increase conversion of your book a demo page (May 2025)

- RevenueHero: The state of demo conversion rates in 2025 (May 2025)

- Ruler Analytics: Average conversion rate by industry and marketing channel (August 2025)

Niche Marketing Strategy:

- Razorpay: What is a niche market? Examples, benefits and strategies (January 2026)

- Victorious: How content marketing drives sales and fuels growth (June 2025)

- UserGrowth: How to use content marketing to drive sales through all stages (September 2025)

- OneBrick: What is a niche – Definition, benefits, and how to determine (March 2025)

- Strategy Institute: Niche market strategy – Complete approach to dominating your segment (December 2025)

Competitive VR/AR Landscape:

- VRDB: Meta Quest 4 – Updated insights (2026 release, dual models) (April 2025)

- Reddit: Meta to focus on 3rd-party VR content (January 2026)

- Best Buy Canada: VR and MR buying guide – Find the best virtual reality headset (July 2025)

- Reddit: Exclusivity is doing the opposite of what they’re trying to achieve (March 2025)