Apple’s Creator Studio launch sparked the usual hot takes: “Adobe killer”, “subscription Trojan horse” (one that I myself wrote yesterday) , “terrible fit for India”. Yesterday, this blog joined in with a neat argument: emerging‑market consumers value ownership, Apple is selling rent, so the strategy is fundamentally misaligned. Today’s piece is the uncomfortable follow‑up. The problem is not that Apple has misread India’s creators. The problem is that it may have read a very specific slice of them almost perfectly—and is timing its move to sit on top of a fragile borrowing culture.[ciol]

This is a correction, not a retraction. The critique stands. The reasoning behind it needs an upgrade.

What yesterday’s argument missed

Yesterday’s piece treated India as a single, coherent market. It framed the Creator Studio bundle as a blunt mismatch with “India’s creator economy”, assuming a broadly shared preference for owning tools rather than renting them every month. That framing felt clean. It also flattened reality.

Once you look more closely at who is actually borrowing, travelling and creating in India’s metros, the picture shifts. Recent travel and credit data show that in the first half of 2025, about 27% of personal loans were taken for holidays, not emergencies or business investments. Meanwhile, reports and financial commentary suggest that around 70% of iPhones in India are bought on EMIs rather than paid for upfront. At the same time, Gen Z now drives roughly 40–45% of India’s discretionary consumption and is projected to control close to half within a decade.[ey]

“These are not the numbers of a generation that instinctively rejects recurring payments. They describe a cohort whose lifestyle is built on them.”

In that light, the neat “ownership culture versus subscription culture” story does not survive contact with the data. It was convenient. It was also wrong.

So if Apple has not misjudged Gen Z’s comfort with subscriptions, what exactly is it doing?

A follow‑up question: what if Apple is timing, not guessing?

Start by narrowing the frame. Creator Studio is not for “India”. It is for a sliver of India: affluent, English‑speaking Gen Z and young professionals in Tier 1 cities who already live inside the Apple ecosystem.[brigadegroup]

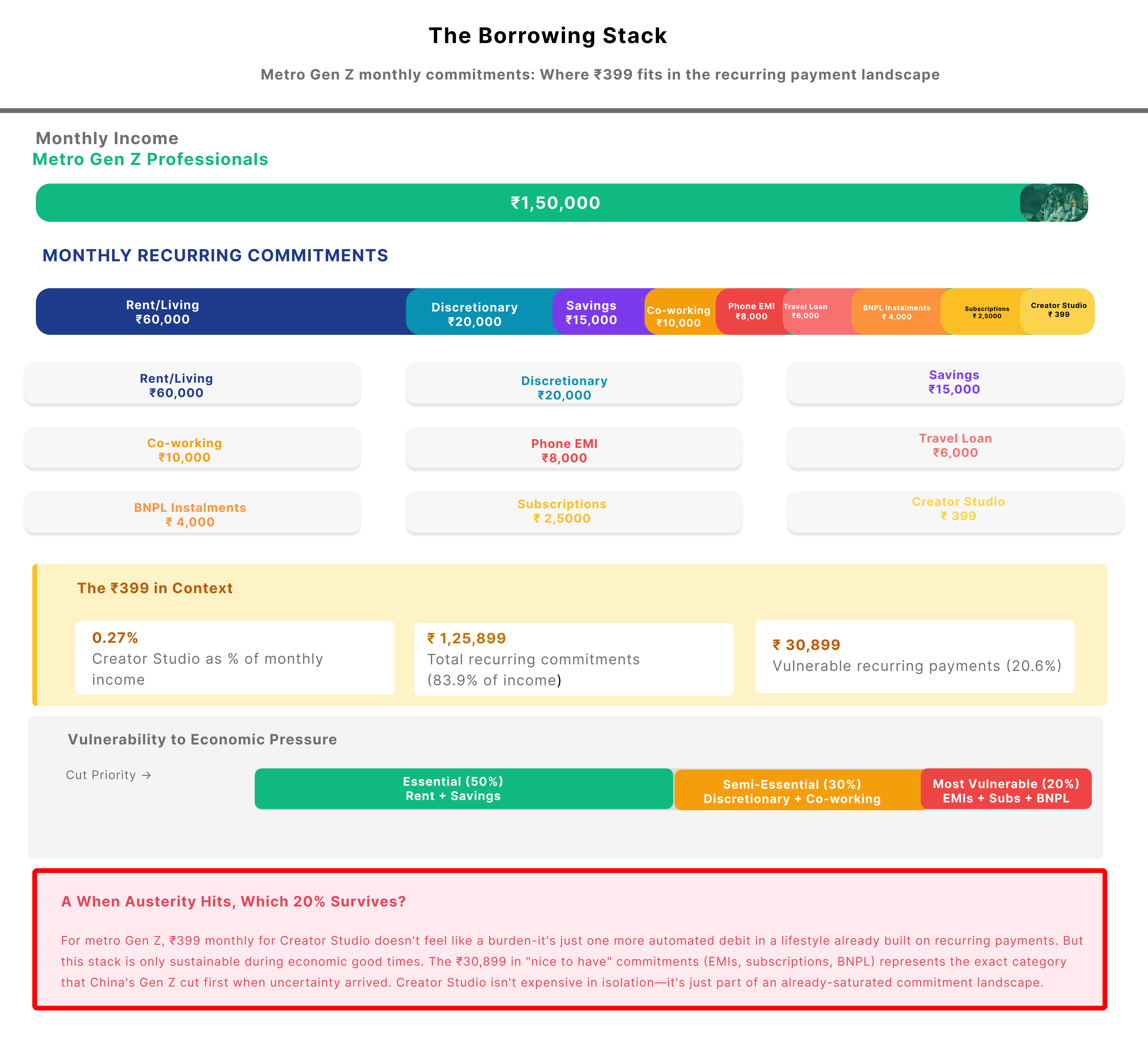

Think about a young engineer in Bengaluru or a designer in Mumbai. They might earn ₹1.5–2 lakh a month, share a flat, and funnel money into a mix of lifestyle and “self‑investment”: phones, laptops, co‑working desks, online courses, perhaps a couple of short foreign trips a year. EMIs are not an emergency tool here; they are part of the operating system.

In that world:

- A phone on a 12‑ or 18‑month EMI is normal.

- A co‑working membership and two or three streaming subscriptions are background noise.

- BNPL for travel or gadgets feels like savvy cash‑flow management, not danger.[outlooktraveller]

Set Creator Studio down in this environment and it does not feel provocative. A ₹399 monthly spend on professional‑grade creative tools sits psychologically next to Spotify, Netflix and a WeWork hot desk. It looks like infrastructure for an identity: “I am a creator, therefore I use these tools.”[apple]

“For Apple’s metro target, Creator Studio does not feel like a new burden. It feels like one more tile in a dashboard of automated debits.”

That is the first uncomfortable realisation. Apple may be reading metro Gen Z money habits very accurately. The second is worse: the more accurate that reading is, the more Creator Studio becomes a bet on a moment of over‑stretch that cannot last.

The metro creator Apple is actually building around

Once you accept that Creator Studio is aimed squarely at Tier 1, the bundle looks almost embarrassingly rational for its intended user.

Consider the alternatives a serious metro creator faces:

- Buy tools outright. Final Cut Pro costs around ₹29,900 and Logic Pro roughly ₹19,900 as one‑time purchases in India. Pixelmator Pro adds close to ₹999. Together, the full stack clears ₹50,000 up front.[apple]

- Subscribe. Creator Studio at ₹399 a month is ₹4,788 a year.[ciol]

Over time, the subscription crosses the perpetual price after about six years. Yesterday, that breakeven point was the punchline: by Year 6, you would have been better off owning the software forever. For the metro creator deciding today, however, the calculation is more nuanced.

Three factors change the equation:

- Cash‑flow and risk. Spreading cost through ₹399 monthly instalments is easier than finding ₹50,000 in one go, even for someone on a six‑figure salary.

- Team workflows. Agencies and studios already invested in Final Cut Pro or Logic Pro treat switching as a coordination problem, not just a personal choice.

- Bundle value. Using all three apps means the subscription arguably saves money over the first few years, before that Year‑6 curve kicks in.[ciol]

“If you use the full stack, the ₹399 subscription looks less like a trap and more like a discount that expires in six years.”

From this angle, Apple does not look delusional at all. It looks like a company presenting a tidy spreadsheet to exactly the sort of customer who responds well to tidy spreadsheets.

The trouble is not in the logic. It is in the backdrop.

When EMI is optimisation in one postcode and pressure in another

The temptation now is to say “fine, so metro Gen Z can afford it; what is the problem?” The problem is that the same financial tools and behaviours—EMIs, BNPL, subscription stacks—mean very different things just a few income brackets down.

For a well‑paid engineer, an EMI is a way to keep money invested while still upgrading a phone. For a junior creator in a Tier 2 city, the same EMI might be the difference between a cushion and no cushion at all. Both patterns, however, are celebrated in the same marketing language of “smart credit”.

Yesterday’s critique framed this as straight exploitation: Apple pushing rent on a market that still wants to own. Today’s view is sharper and less flattering to the rest of us. Apple is not convincing a disciplined generation to accept subscriptions. Instead, it is sliding a new, glossy line item into the monthly stack of a group already saturated with commitments.

“Apple is not teaching Gen Z to love subscriptions. Fintech already did that. It is arriving just in time to sit on top of the mess.”

Marketers, watching this from the sidelines, risk taking precisely the wrong lesson: that “Gen Z loves subscriptions” and that any half‑decent product can be converted into a monthly fee without much pushback. The more crowded that landscape becomes, the less room there is for error when something in the macro environment moves.

And something will move. It already has elsewhere.

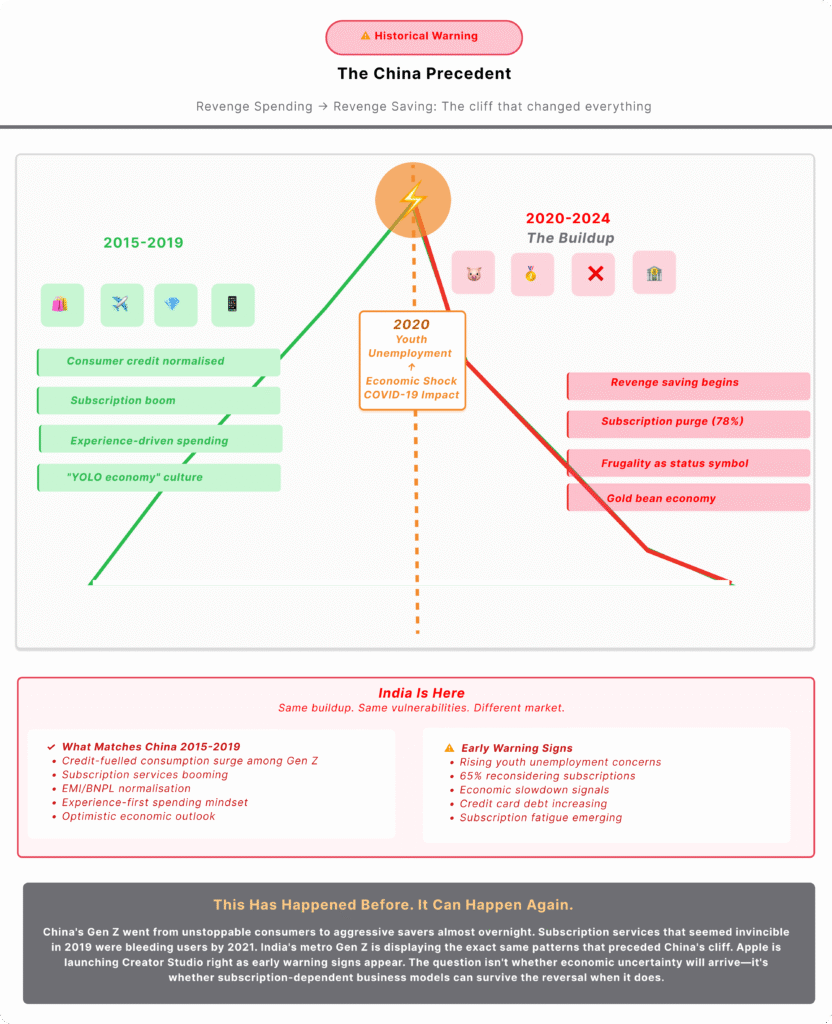

The China precedent marketers should not ignore

China’s experience is not a perfect map for India, but it is close enough to matter.

Between roughly 2015 and 2019, Chinese Gen Z embraced consumer credit with an enthusiasm that now looks uncomfortably familiar. Luxury purchases, travel and gadgets were happily financed. Consumption fuelled identity, and recurring payments were simply the cost of performing that identity.[outlooktraveller]

Then economic uncertainty and youth unemployment rose. Very quickly, the mood turned. “Revenge saving” replaced “revenge spending”. Gold beans, savings challenges and frugality content took over the feeds where shopping hauls had lived. Young consumers began combing through their bank statements and cutting everything that did not feel essential. Subscriptions—media, software and lifestyle—were some of the first to go.[outlooktraveller]

The key detail is that this reversal was not gradual. Behaviour did not gently slope down; it fell off a cliff.

India is not at that cliff—yet. Nevertheless, it has the ingredients for a similar wobble: stubborn youth joblessness, expensive metros, and a large group of young adults whose assets are thin while their monthly obligations are thickening. If that wobble happens, the very class Apple is targeting with Creator Studio will be in the blast radius. That is where the most subscriptions and the most EMIs live.[linkedin]

Apple can withstand that shock. It can treat Creator Studio as a two‑ or three‑year experiment in deepening its ecosystem and walk away if the numbers stop making sense. Very few marketers have that luxury.

Why this follow‑up matters for marketers, not just for Apple

This is where the “after thought” becomes the actual point. Yesterday’s piece obsessed over Apple’s motivations. Today’s argues that the real risk sits with everyone else trying to ride the same wave.

Three questions, in particular, deserve to live on every subscription deck aimed at young, urban consumers.

1. Are you building on preference or on pressure?

There is a clear difference between a customer who chooses a subscription because they like flexibility and one who chooses it because they cannot afford the upfront purchase.

The first will usually keep paying through mild shocks. The second will churn the moment income tightens or credit gets even slightly harder to access. Apple’s metro target group straddles that line: some can easily buy outright and still choose the bundle; others genuinely cannot. If your ideal customer looks more like the latter than the former, your model is exposed.

2. Would your product survive a personal austerity drive?

Imagine a designer in Gurgaon or an engineer in Bengaluru three years from now. Hiring has slowed. Salary increases are thin. Their feed is full of “how I paid off my debt by cancelling 12 subscriptions” threads.

They open their banking app and look at every recurring line. What survives that audit? Tools that are genuinely income‑adjacent, core communications, maybe one fitness or mental health subscription that feels essential. Everything else is vulnerable.

If your product sits in the “nice to have, but I can live without it for a year” column, counting on Apple‑style resilience is optimistic at best.

3. Do you know exactly who you are excluding—and can you say it aloud?

Here, Apple is both sharper and slipperier than most brands.

Internally, it seems safe to assume that Creator Studio is defined for a very specific persona: metro‑based, Apple‑equipped, professionally adjacent to content. Externally, the marketing speaks broadly of “creators in India”, including those who will never be able to run, let alone pay for, the suite.[brigadegroup]

That tension matters, because it reveals a broader industry reflex: design for the top segment, market to everyone, and hope the excluded do not notice. In a media environment where creators from outside Tier 1 are increasingly vocal, “being noticed” is not a hypothetical risk.

“It would be more honest—and more useful—for subscription businesses to admit who they are not building for. Apple seems clear on that privately. Its advertising is not.”

Being explicit about exclusion forces better product decisions and avoids the reputational hit of claiming inclusion while designing for scarcity.

Copying Apple’s surface moves is the real danger

The most dangerous outcome of Creator Studio’s launch is not a failed product. It is a wave of marketers copying the surface of Apple’s strategy—premium bundle, soft‑focus launch film, neat monthly price—without the balance sheet, ecosystem or segment clarity to back it up.[apple]

Apple is playing a timing game on top of a deep moat:

- Devices, services and status are already tightly woven for its best customers.

- Creator Studio is additive, not foundational, to that relationship.

- Very few people will choose or reject Apple hardware purely because of this bundle.

If you run a subscription‑first business, the arrow points the other way. The subscription is the relationship. If it breaks, the brand often snaps with it.

This is why the follow‑up to yesterday’s thesis matters. The issue is no longer just “subs versus ownership” or “India versus the West”. The issue is whether you are building a long‑term business on the back of a short‑term borrowing mood, and whether you have the honesty and resilience to survive when that mood turns.

A more useful takeaway than “Gen Z loves subscriptions”

After a day of sitting with Creator Studio, the correction to the original critique is simple enough to write and awkward to live with:

“Apple is not naïve about India’s creators. It knows exactly which ones can and will pay, and it is happy to build around that sliver.”

The company is not betting on some timeless cultural preference for subscriptions. Instead, it is leaning into a specific financial moment in metro India where recurring payments feel like the only way to access the life young people are told they should want. That moment will not last. When it ends, Apple will still have hardware margins, App Store fees and a broad services portfolio.[ey]

Most of the businesses copying it will not.

The useful question for marketers is not “is Apple right or wrong about Creator Studio?”

The useful question is: “If I launch my own version of this now, am I building for the window, or for what is left when the window closes?”

Yesterday’s take focused on Apple’s apparent misreading of India. Today’s reveals a more unsettling possibility: Apple may have read the room perfectly, but the room itself is temporary. Building your strategy around a temporary room is not bold. It is borrowed time.

Sources

- Apple India – Apple Creator Studio product page.[apple]

- CIOL – Apple confirms India launch date and pricing for Creator Studio.[ciol]

- EY x Economic Times – The Great Indian Traveller (Gen Z and millennial travel and credit patterns).[ey]

- NDTV Travel – Millennials and Gen Z dominate India’s global travel in 2025.[ndtv]

- Commentary on iPhone EMI penetration and early credit adoption among young Indians.[linkedin]

- Brigade Group – Top talent cities in India (Bengaluru, etc.).[brigadegroup]

- Aurum PropTech / LinkedIn – Top cities for Gen Z work‑life balance.[linkedin]

- Abhinav Singh Sengar / LinkedIn – Gen Z drives 43% of India’s discretionary spending.[linkedin]

- Coverage of youth employment stress and metro lifestyle pressures in India.[economictimes]

- Reporting on China’s shift from “revenge spending” to “revenge saving” among Gen Z.[outlooktraveller]