Apple just wrapped a fundamental business model shift in 35 seconds of upbeat music and minimalist aesthetics. Yesterday’s Creator Studio launch video is a masterclass in what you’re not being told—and what that silence means for everyone selling subscriptions in 2026.

The video itself is classic Apple: clean product shots, energetic soundtrack, zero technical jargon. Final Cut Pro, Logic Pro, Pixelmator Pro bundled together for ₹399 monthly in India, $12.99 in the US . Launch date 28 January. Job done. Except the real story isn’t what Apple said. It’s what it’s betting you won’t notice until it’s too late.

Here’s the gambit marketers need to understand: Apple is quietly abandoning decades of premium, ownership-based software sales and betting its creative future on subscriptions .

Not alongside perpetual licences—instead of them, eventually. The one-time purchase options still exist for now , but several “exciting new intelligent features” in Final Cut Pro, Pixelmator Pro, Keynote, Numbers, Pages and Freeform are now subscription-exclusive .

That’s the move. Apple’s testing how much it can paywall before users revolt.

If you’re running subscription marketing in rising economies, this should terrify you. Because Apple’s about to discover what you probably already know: subscription fatigue isn’t just a Western phenomenon anymore.

The subscription exhaustion reshaping emerging markets

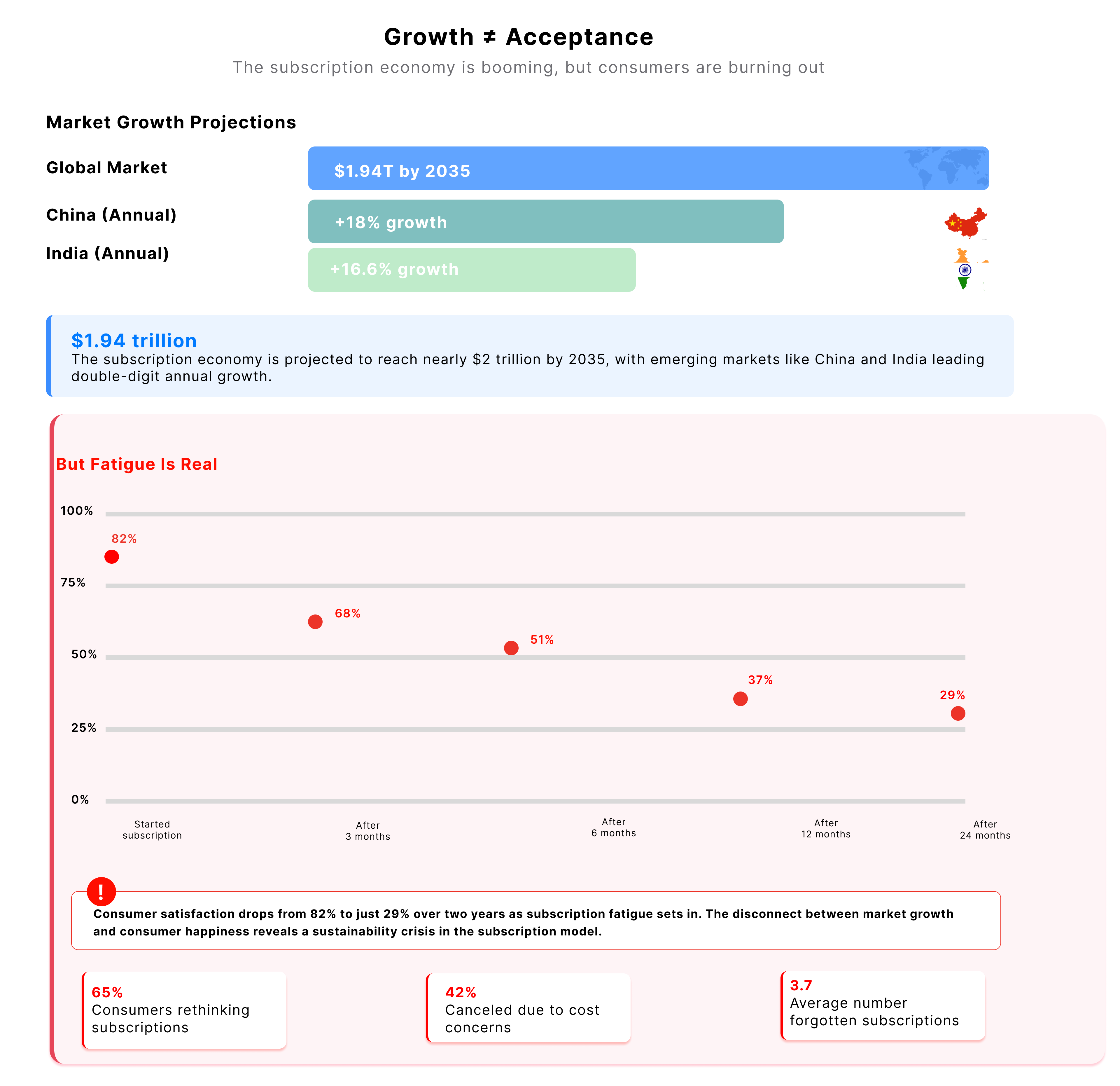

Growth doesn’t equal acceptance

The subscription economy is exploding globally—projected to hit $1.94 trillion by 2035, with China growing at 18% annually and India at 16.6% . However, growth isn’t the same as acceptance. In India specifically, consumers are rethinking monthly plans, questioning whether recurring commitments deliver actual value .

The psychological burden transcends geography. Indian households managing multiple OTT subscriptions, food delivery memberships and SaaS tools face the same cognitive overhead as their Western counterparts . Consequently, every new subscription adds mental load: tracking what you’re paying for, whether you’re using it, when renewal hits, whether this month’s the month you finally cancel.

Social validation trumps features

What makes emerging markets different isn’t the fatigue itself—it’s the stakes. In a recent cross-cultural study comparing India and Australia, researchers found that Indian consumers practice “social portfolio management” with subscriptions . Rather than focusing on features alone, they maintain multiple subscriptions primarily to stay connected—to conversations, families, peer groups and shared cultural moments. Social validation matters more than technical features. Indeed, a platform doesn’t need the most advanced technology if it’s socially endorsed.

But here’s the catch: subscription fatigue in India isn’t about having too many subscriptions—it’s about having the wrong mix.

When platforms fail to contribute meaningfully to a user’s social or experiential portfolio, they feel expendable. For Apple, this creates a uniquely challenging landscape. Creator Studio doesn’t enable social connection. Instead, it’s productivity software entering a market where consumers already carefully curate which recurring costs justify their social and cultural value.

The creator economy paradox in rising markets

India’s trillion-dollar opportunity—built on different tools

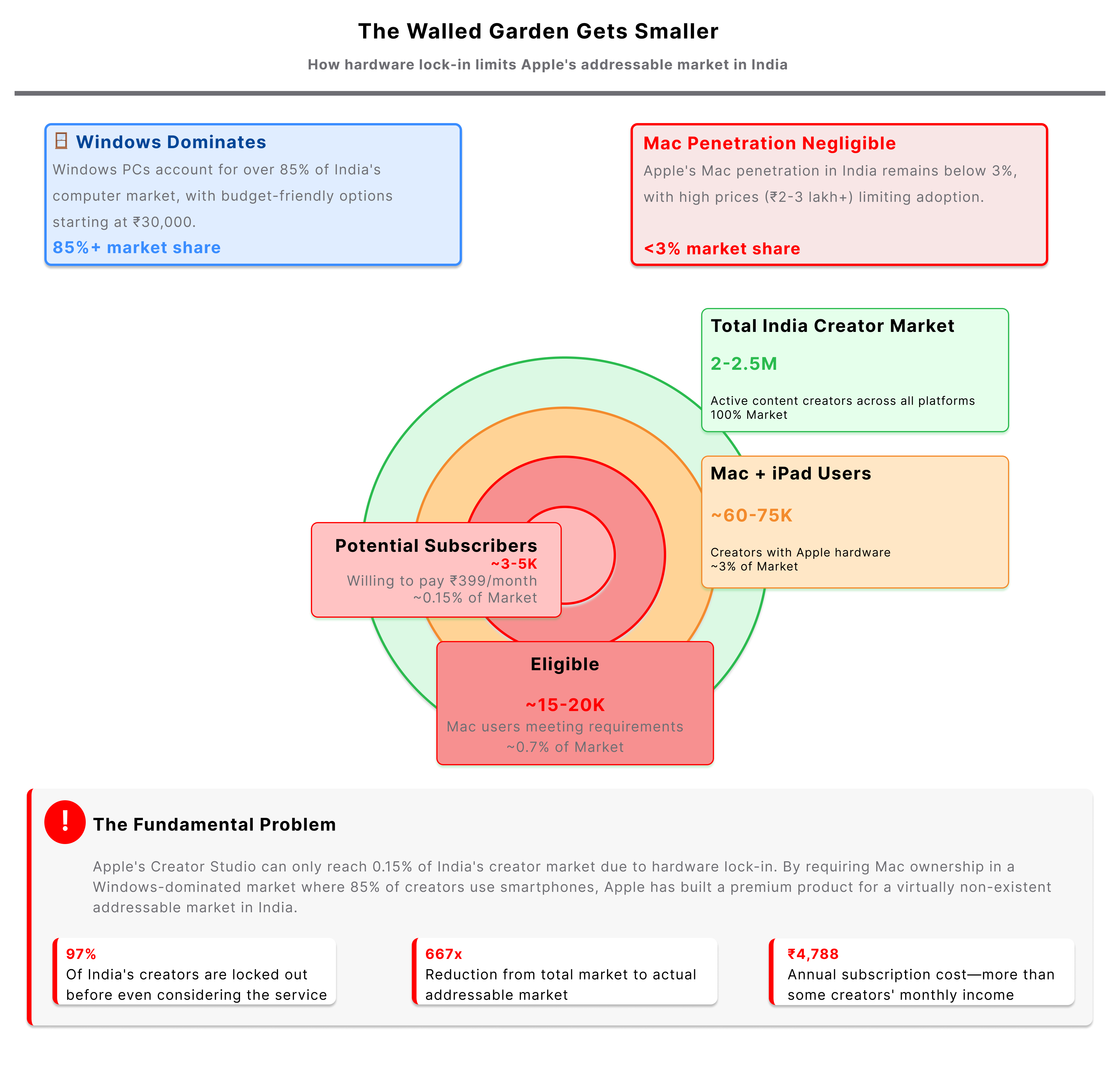

India’s creator economy is projected to influence over $1 trillion in annual consumer spending by 2030, up from $350-400 billion currently . The country has 2-2.5 million monetised digital creators, and over 60% of consumers regularly engage with creator-generated content . Moreover, the Indian creator economy market alone is expected to grow from $1.46 billion in 2025 to $5.93 billion by 2032, exhibiting a CAGR of 22.2% .

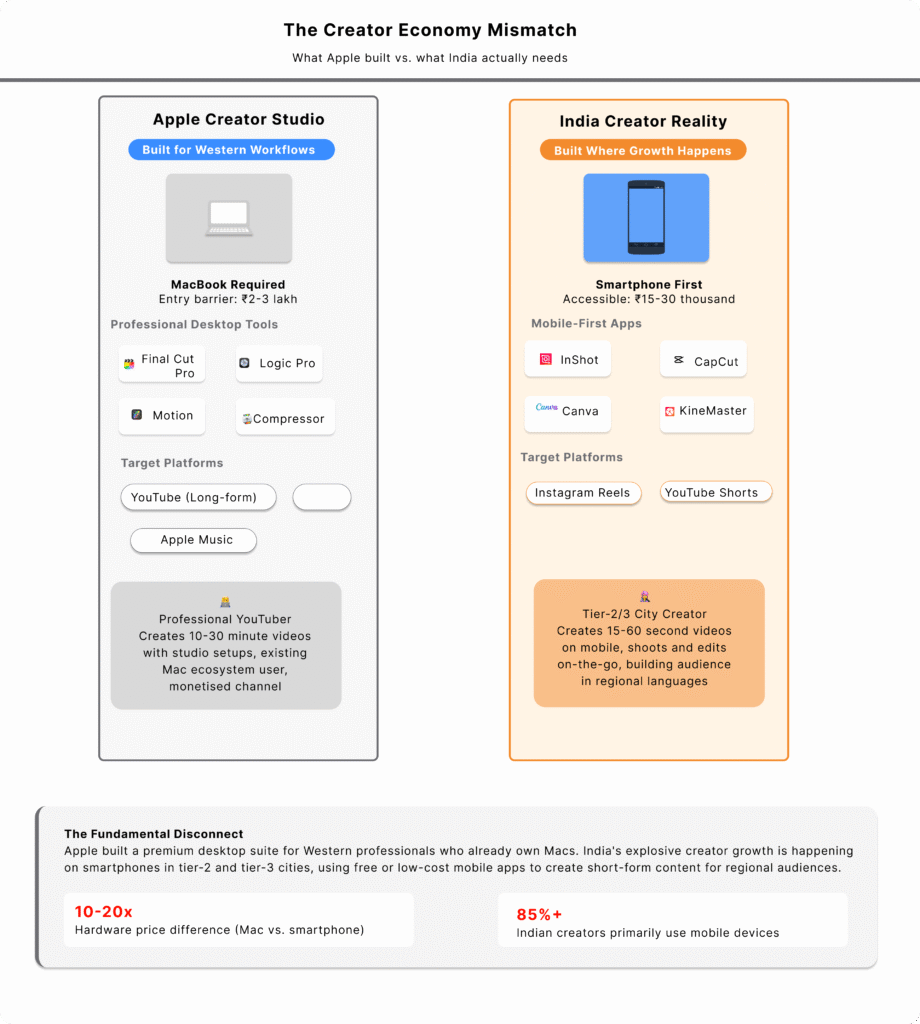

That’s massive opportunity. Nevertheless, here’s what Apple’s missing: India’s creator explosion is happening despite, not because of, premium creative software. Indian creators are thriving on mobile-first platforms using free or freemium tools. They’re editing on smartphones, producing content optimised for vertical video and building audiences on Instagram Reels, YouTube Shorts and regional platforms that don’t require Mac hardware.

Consequently, Apple’s positioning Creator Studio for a creator economy that’s already moved past needing Final Cut Pro.

The tools professional Western YouTubers use aren’t what’s driving India’s creator boom. Instead, social commerce, live streaming and UGC (user-generated content) matter more than colour grading and multi-track audio mixing .

Southeast Asia tells the same story

Southeast Asia tells a similar story. The region’s consumer market is set to reach $5 trillion in private consumption by 2035, with TikTok Shop already driving approximately 20% of all online commerce . Similarly, creators in Indonesia, Vietnam and Thailand are monetising through embedded commerce, not through professionally edited video essays that require Mac-exclusive software.

Apple’s betting on the wrong creator economy.

What Adobe’s dominance actually teaches us

Infrastructure beats pricing

Apple’s positioning this as an Adobe Creative Cloud competitor. The price comparison looks compelling: ₹399 versus Adobe’s significantly higher monthly cost for the all-apps plan . Yet that comparison obscures the actual competitive landscape in emerging markets.

Adobe owns roughly 90% of the creative software market globally . Not because its products are beloved—many designers actively resent Adobe—but because it achieved something Apple hasn’t: it became infrastructure. Adobe is what film schools teach. It’s what collaborative teams default to. Furthermore, it’s the verb for image editing .

But in India, China and Southeast Asia, neither Adobe nor Apple are infrastructure for the creator economy that’s actually growing. Regional platforms, mobile apps and browser-based tools are what millions of creators actually use. Thus, the subscription battle between two Western software giants misses the market reality: most creators in emerging economies can’t afford either, won’t buy Mac hardware, and don’t need desktop-class tools for the content they’re producing.

Workflow dominance protects against churn

The lesson for subscription marketers: dominance protects you from churn in ways pricing cannot.

If you’re not infrastructure—if customers can switch without breaking their entire workflow—you’re vulnerable regardless of how good your bundle looks. This echoes the insights from my analysis of challenging entrenched incumbents : when a dominant player owns the workflow, price alone won’t dislodge them. However, in emerging markets, the workflow itself is fundamentally different.

The ecosystem trap becomes a growth wall

Exclusivity masquerading as accessibility

Apple’s video celebrates seamless integration across Mac and iPad. For all-Apple users, this genuinely delivers value. However, for everyone else—which is the vast majority of emerging market consumers—it’s a wall.

Creator Studio is exclusively for Mac and iPad users . You can’t run it on Windows. Moreover, you can’t collaborate easily with teams using different platforms.

Apple’s promoting “accessibility” that requires owning premium Apple hardware first.

In India, where a MacBook Pro costs ₹2-3 lakh (roughly $2,400-3,600), that’s not accessibility—it’s exclusivity masquerading as democratisation .

Hardware success doesn’t guarantee services scalability

Apple is doing well in India on hardware—the company set all-time revenue records in the September 2025 quarter, with iPhone 16 driving 60% year-over-year growth . Nevertheless, that’s largely iPhone growth in the premium segment and aspirational middle class. Mac penetration remains negligible compared to Windows, and iPad isn’t displacing laptops for professional work.

This ecosystem lock-in that works brilliantly for hardware becomes a growth ceiling for subscriptions. Specifically, you can only sell Creator Studio to people who’ve already bought Macs. In India, where PC market share heavily skews Windows, you’re marketing to an addressable audience capped by your hardware install base. Meanwhile, Adobe runs everywhere .

The China challenge compounds the problem

China presents an even starker challenge. Apple absorbed $1.1 billion in tariff costs last quarter and expects another $1.4 billion hit . The company is shifting iPhone assembly to India to diversify supply chains, but services revenue—which Creator Studio feeds into—remains dependent on an installed base facing intense competition from local Chinese brands. Consequently, when hardware growth struggles, subscription services built exclusively for that hardware face compounding difficulties.

For subscription marketers in emerging markets, the strategic question is stark: are you building products that deepen existing customer relationships, or can you actually grow your addressable market? Apple’s choosing the former and calling it growth. In mature Western markets, that might work. However, in rising economies with low hardware penetration, it’s a ceiling disguised as strategy.

The pricing illusion in purchasing power reality

The maths that Apple isn’t showing you

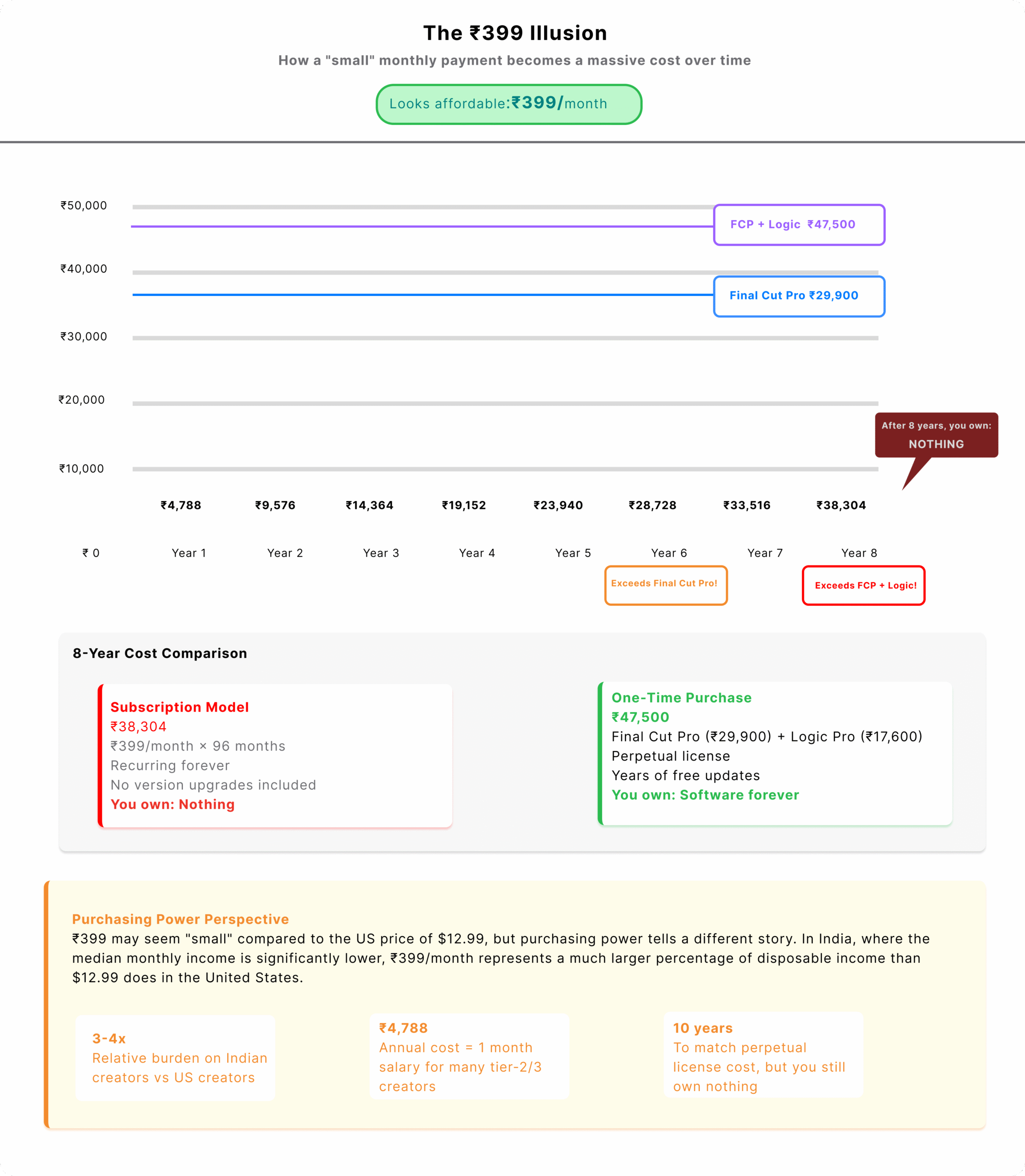

₹399 per month sounds affordable. But context matters. That’s ₹4,788 annually—roughly the cost of a budget smartphone in India. For students and educators, Apple offers ₹199 monthly . Still, the one-time purchase alternative tells the real story: Final Cut Pro costs ₹29,900 as a standalone purchase, Logic Pro ₹19,900, Pixelmator Pro ₹999 .

Professional creators will do the maths: ₹399 monthly is ₹4,788 annually. After two years, you’ve paid ₹9,576. After six years, you’ve paid more than a Final Cut Pro perpetual licence. After eight years, you’ve paid more than Final Cut and Logic combined. And you own nothing. Cancel the subscription and your creative tools vanish .

Purchasing power parity changes everything

This calculation gets worse when you factor in purchasing power parity. Specifically, ₹399 represents a larger percentage of disposable income for Indian creators than $12.99 does for American creators. The “affordable” positioning works only if you ignore the economic reality that Indian creators already navigate: limited budgets, multiple competing subscription demands and a cultural preference for ownership over rental .

The subscription e-commerce market in Asia-Pacific (excluding China) is projected to reach $826.39 billion in 2025, with India specifically at $31.47 billion and China at $478.48 billion . That’s massive growth. However, it’s driven by streaming entertainment, food delivery, e-learning and fintech—categories where subscriptions provide ongoing, consumable value. In contrast, software subscriptions are harder sells when the core product doesn’t meaningfully change month-to-month.

What the silent bits reveal about market misreading

The problems Apple isn’t solving

Watch what Apple’s 35-second video doesn’t say. It doesn’t mention that longtime users who purchased apps outright will now face paywalled features. Furthermore, neither does it address why professional video editors continue choosing Premiere over Final Cut for collaborative work. Most tellingly, the video doesn’t acknowledge that Pixelmator Pro lacks the generative AI capabilities that make Adobe Firefly genuinely useful .

Most tellingly for emerging markets, the video doesn’t explain how this solves the problems Indian, Chinese or Southeast Asian creators actually face. Those problems aren’t “I wish Final Cut Pro and Logic Pro were bundled.” Instead, they’re: “I can’t afford Mac hardware,” “My clients use Windows,” “My internet is too unreliable for large video files,” “My audience watches vertical video on mobile,” “I need real-time collaboration with my team in different cities.”

Wall Street expectations trump customer needs

Apple’s not solving customer problems here. Rather, it’s solving a Wall Street expectation problem.

Services revenue hit $109.16 billion in fiscal 2025, up 13.5% year-over-year, representing more than a quarter of Apple’s total sales with gross margins above 75% . That conviction that subscription services can become a “structural growth driver” as hardware upgrade cycles slow reveals the company’s true motivation.

In emerging markets experiencing rapid digital adoption, hardware isn’t actually slowing—it’s simply not Apple hardware. The growth is Android phones, Windows laptops and cloud-based tools that don’t require expensive local hardware. Meanwhile, Apple’s services strategy works brilliantly in markets where ecosystem penetration is already high. In rising economies, however, the company is building premium services for a foundation that hasn’t been laid yet.

Trust erosion in price-sensitive markets

The marketing implication is stark: when you shift to subscriptions because your business model demands it rather than because customers want it, you’re starting from a position of misalignment.

Every retention strategy becomes an exercise in overcoming inherent customer resistance.

This reminds me of the demo trap I analysed with Google’s Gemini —when your marketing promises diverge from what customers actually experience, trust erodes fast.

In price-sensitive emerging markets, that erosion happens even faster.

The acquisition playbook and the ownership culture clash

From ownership to rental—a cultural violation

Apple’s November 2024 acquisition of Pixelmator deserves attention through an emerging market lens . Pixelmator was beloved by Mac users as an affordable Photoshop alternative—a one-time ₹999 purchase. Subsequently, Apple bought it, folded it into Creator Studio and made advanced features subscription-only.

For Western users accustomed to software-as-a-service models, this might feel inevitable. However, for Indian, Chinese and Southeast Asian users, it violates cultural expectations around ownership. Research on subscription behaviour in emerging markets shows that despite growing digital adoption, many consumers still prefer cash transactions and ownership models over recurring digital payments .

The Pixelmator users who paid ₹999 once now pay ₹399 monthly—forever . That’s the pattern to watch.

Essentially, Apple’s not building subscription value through organic feature development. Instead, it’s acquiring established products with loyal user bases and converting them to subscriptions. It works financially for Apple. Nevertheless, it also breeds exactly the kind of resentment that drives churn—especially in markets where ownership expectations run deeper than subscription convenience.

The real test in markets that matter

28 January: When theory meets reality

Apple’s Creator Studio launches on 28 January . That’s when we’ll see whether Apple’s brand equity can overcome subscription economics that punish everyone else—particularly in emerging markets where those economics are fundamentally different.

My bet: it won’t scale the way Apple needs it to. Not because Creator Studio is badly designed—it isn’t—but because the fundamental value exchange is broken for rising economy consumers. Subscriptions work when they provide ongoing value that justifies recurring payment. Cloud storage? Yes. Streaming content libraries updated weekly? Sure. Access to software that doesn’t meaningfully improve month-to-month, requires expensive hardware and solves problems most local creators don’t have? That’s the harder sell.

Investment flowing to different infrastructure

Southeast Asia’s private capital space represents just 0.5% of regional GDP—far below the global average of 1.5% . Meanwhile, FDI is flowing into AI infrastructure, data centres and cloud computing . But that investment isn’t translating to desktop creative software adoption. Instead, it’s mobile-first platforms, social commerce infrastructure and collaboration tools that work across device ecosystems.

Similarly, China’s 2026 strategy focuses on supply-side reforms, shifting manufacturing inland while coastal regions concentrate on services, AI and R&D . That’s a creator economy play, but not one that requires Final Cut Pro. Rather, it requires platforms that enable commerce, facilitate collaboration and integrate with Chinese digital ecosystems where Apple remains a premium foreign brand with limited services integration.

What marketers in emerging markets should actually learn

Five hard truths about subscription models

Apple’s Creator Studio launch isn’t a marketing triumph. Rather, it’s a stress test of whether Western subscription playbooks work in rising economies. Apple’s betting that brand loyalty, ecosystem integration and competitive pricing can overcome subscription fatigue, platform exclusivity, purchasing power realities and fundamentally different creator workflows. That’s a genuinely risky bet.

The lessons for subscription marketers in India, China, Southeast Asia and other emerging markets follow.

1. Price isn’t moat—context is

Apple’s undercutting Adobe by 81% on monthly cost. That’s aggressive pricing from a company that built its brand on premium products. However, ₹399 isn’t affordable if it requires ₹2 lakh hardware and doesn’t solve local workflows. Your pricing advantage disappears when competitors operate on different infrastructure entirely—like mobile apps, browser tools or platforms that work on any device.

2. Bundling only works when the bundle makes sense locally

Creator Studio bundles apps that Western professional creators might use together. Nevertheless, Indian music producers editing content for Instagram Reels don’t need MainStage for live performance. Similarly, Southeast Asian video creators producing TikTok content don’t need Motion for complex animation. You’re asking customers to pay for breadth they won’t use . In emerging markets where every rupee matters, bundling complexity becomes a liability, not value.

3. Ecosystem lock-in is a retention tax in markets you haven’t won yet

Apple can charge for Creator Studio partly because switching costs are high for existing Mac users. However, in markets with low Mac penetration, lock-in isn’t retention—it’s market exclusion. Retention through friction works despite your product, not because of it. As I explored in my critique of Apple’s iPhone 17 Pro campaign , when your messaging sidesteps fundamental product limitations, you’re building on sand. In emerging markets, that sand is hardware penetration you don’t have.

4. Cultural expectations around ownership trump convenience

Western consumers increasingly accept “you’ll own nothing and be happy.” Yet that messaging fails in markets where ownership signifies economic progress and security. Research shows Indian consumers maintain subscriptions strategically, keeping only those that provide social value or align with peer groups . Therefore, professional software that isolates you in a premium ecosystem doesn’t provide social validation—it signals economic isolation from collaborators using more accessible tools.

5. Mobile-first isn’t just a feature—it’s the foundation

The subscription e-commerce boom in Asia-Pacific is driven by smartphone adoption and mobile commerce penetration . Consequently, subscriptions succeeding in India, Indonesia, Vietnam and the Philippines are mobile-native, not desktop-with-mobile-support. Creator Studio fundamentally misreads the hardware landscape where growth is actually happening.

What happens when even Apple can’t make emerging market subscriptions work?

The chicken-and-egg problem

Here’s the genuinely interesting scenario: what happens if Creator Studio underperforms in the markets that matter most for Apple’s growth? The company set revenue records in India, but those are hardware-driven . Services revenue globally depends on ecosystem expansion, but emerging markets present a chicken-and-egg problem: you need hardware penetration to sell services subscriptions, but services don’t meaningfully drive hardware adoption when they’re platform-exclusive.

If even Apple—with unmatched brand aspiration, premium positioning and record hardware growth in emerging markets—struggles to convert users to creative software subscriptions, that’s a signal for the entire subscription economy. It would mean subscription fatigue isn’t just a messaging problem you can overcome with better onboarding. Instead, it’s structural resistance to business models that extract ongoing value while delivering diminishing ownership—particularly in markets where economic progress has historically meant accumulating assets, not renting access.

We’ve optimised for the wrong consumer

For marketers, that’s the uncomfortable truth this launch forces into focus. We’ve spent years optimising subscription funnels, reducing friction, personalising onboarding, A/B testing pricing pages. However, we’ve optimised for Western consumer behaviour. Emerging markets have different expectations: stronger ownership preferences, lower tolerance for platform lock-in, more price sensitivity and fundamentally different workflows that our premium tools don’t address.

The Creator Studio video is 35 seconds of beautiful evasion.

Essentially, it’s selling a future where subscriptions feel like freedom rather than recurring extraction. That future has never existed for any subscription business in any market.

Nevertheless, Apple’s betting it can will it into existence in the world’s fastest-growing digital economies through design, pricing and ecosystem control.

I’d love to see the churn projections they’re not showing us for India and Southeast Asia specifically. Because if Apple can’t make this work in markets driving the next decade of digital growth, the rest of us should be asking much harder questions about whether we’re optimising subscription models for markets that are already moving past them. Much like Amazon’s Five Star Theater campaign proved that authenticity trumps aspiration, perhaps ownership will ultimately trump subscription in emerging markets—no matter how beautifully you package it, no matter how aggressively you price it.

The ₹399 question nobody’s asking

Cultural misalignment wrapped in minimalist design

The video ends with the tagline: “It’s all yours for the making.” Except it’s not yours. It’s rented. Month after month after month.

In markets where “yours” has always meant something you could own, touch and pass down, that gap between promise and product isn’t just marketing tension—it’s cultural misalignment.

India’s creator economy will hit $1 trillion in influence by 2030 . China’s subscription economy is growing at 18% annually . Southeast Asia’s consumer market is heading toward $5 trillion . Those are the markets that will define subscription success or failure this decade.

Consequently, Apple’s launching a premium, platform-exclusive, ownership-denying subscription into the middle of that transformation and hoping brand equity overcomes market reality. That’s not confidence—it’s a miscalculation wrapped in minimalist design.

Where the next billion creators are building

Watch this space. 28 January will tell us whether marketing can still overcome economics in emerging markets, or whether the subscription model that conquered the West will find its limits in the East—where the next billion creators are building on different foundations entirely.

The real test isn’t whether Apple can sell subscriptions to the Mac users it already has. Rather, it’s whether it can sell subscriptions to the markets it desperately needs.

My bet: ₹399 monthly sounds affordable until you realise you’re paying for access to tools built for workflows, hardware and cultural expectations that don’t match the markets driving digital growth.

Apple’s just made subscription fatigue beautiful enough for Western tech journalists to swoon.

But the creators in Bangalore, Jakarta, Manila and Shenzhen? They’re already building their empires on tools Apple didn’t even think to compete with.

That’s the story this video isn’t telling—and the market reality Apple’s about to learn.

References

External Sources:

- Hindustan Times – Apple launches Creator Studio subscription

- Moneycontrol – Apple launches Creator Studio

- TechCrunch – Apple launches Creator Studio bundle

- Apple Newsroom – Introducing Apple Creator Studio

- Hacker News – Apple Creator Studio discussion

- Reddit – Apple Creator Studio suite launching

- MacRumors – Apple Creator Studio exclusive features

- Future Market Insights – Subscription Economy Market

- Pune Mirror – India’s consumers rethinking monthly plans

- LinkedIn – Subscription Fatigue & Value Bundling

- Business Fundas – Subscription Fatigue Is Real

- DD News – India’s creator economy set to drive $1 trillion

- Economic Times – Creator economy is worth a billion bucks

- Coherent Market Insights – India Creator Economy Market

- Kotak Mutual Fund – Inside India creator economy

- Consultancy Asia – Southeast Asian consumer market boom

- Digit – Apple Creator Studio vs Adobe Creative Cloud

- Gizmodo – Apple hits Adobe where it hurts

- LinkedIn – Adobe generates $20 billion in revenue

- Y.M.Cinema – Apple Final Cut Pro is not Pro anymore

- The Verge – Apple Creator Studio apps subscription

- Times of AI – Apple Creator Studio all-in-one

- Reddit – CMV: Apple closed systems

- Tech Constant – Apple’s Lock-in

- CDO Times – Apple’s Ecosystem Strategy

- Hindu Business Line – Apple logs double-digit revenue growth

- LinkedIn – Apple sets all-time high revenue in India

- NDTV – Apple clocks all-time revenue growth in India

- LinkedIn – Apple’s Real Strategy: Ecosystem Lock-In

- Saxo – Apple earnings

- Saxo – Apple earnings tariff costs

- Fone Arena – Apple Creator Studio Subscription Suite launched

- Fortune Business Insights – Subscription E-commerce Market

- Forbes – Apple’s Desperate Pivot

- Tech Times – Future of Apple Services 2026

- MacRumors – Apple Acquires Pixelmator

- Bloomberg – Apple to Buy Pixelmator

- Michael Tsai – Apple Acquires Pixelmator

- Magnaquest – Rise of Subscription Economy

- PetaPixel – Creator Studio Apple’s Answer to Adobe

- Business Times Singapore – What will power South-east Asia in 2026

- Asia Times – China’s 2026 stimulus plan