The streaming giant’s 2025 trends report celebrates “authenticity” and “community” while hiding the algorithmic exploitation that makes both possible. Here’s what the cheerleading obscures.

On a Monday in December 2025, YouTube published its annual Global Culture & Trends Report—a glossy 12-country analysis of “the year’s most-subscribed creators” designed to reveal “globally-relevant snapshots of essential, emerging themes shaping the future of creativity.”

Within 48 hours, marketing LinkedIn was ablaze. Agencies quoted Korean creators’ “unfiltered authenticity.” Brand strategists screenshot Mexico’s “live-streamed reality shows.” Media planners circulated France’s “creators as new broadcasters.” The report became instant gospel for how to spend 2026 ad budgets.

Here’s what nobody seemed to notice: YouTube’s culture report is propaganda. Sophisticated, data-backed, genuinely insightful propaganda—but propaganda nonetheless.

It’s a document engineered to attract your advertising dollars while systematically erasing the algorithmic manipulation, revenue extraction, and labor exploitation that actually powers the creator economy. And judging by the 65.1% of marketers planning to increase YouTube budgets this year, it’s working exactly as intended.

The Authenticity Con

Let’s start with the report’s most brazen contradiction: its obsessive celebration of “authenticity.”

The Korea section gushes over MMA fighter Choo Sung-hoon’s “unfiltered authenticity”—particularly a room tour revealing his “messy home exactly as it was” that scored 10 million views. Germany praises creators crafting “face-to-face community encounters” as response to disappeared “third places.” The U.S. highlights “direct-to-fans” formats where creators give audiences “a sense of agency.”

Beautiful stuff. Except authenticity on YouTube isn’t authentic anymore—it’s algorithmic performance art.

When Algorithms Reward Vulnerability, Personality Becomes Performance

The creator economy faces what industry observers are calling an “authenticity crisis.” AI-generated content floods feeds. Consumer trust wanes. But more fundamentally, when algorithms reward vulnerability, personality becomes performance. Korean creators don’t show messy homes because they’re wonderfully unfiltered—they do it because YouTube’s recommendation system has trained them that manufactured rawness drives engagement. The “unfiltered authenticity” YouTube celebrates is actually hyper-filtered content optimised for algorithmic distribution.

Fake Authenticity” and What It Reveals

As I explored in my analysis of Amazon’s Five Star Theater campaign, we’ve reached peak “fake authenticity”—when everyone is performing relatability, the only radical move left is to actually be real. Amazon’s approach—performing real, unfiltered customer reviews with theatrical seriousness—demonstrates what genuine authenticity looks like when brands stop trying so hard. YouTube’s report celebrates the symptom while ignoring the disease.

The Korea analysis inadvertently proves this. It celebrates both “unfiltered authenticity” and “meticulously crafted fictional personas” as equally successful strategies. These aren’t contradictions—they’re two sides of the same coin. What matters isn’t genuine human connection but content that performs well within YouTube’s black-box recommendation engine.

The Algorithm YouTube Won’t Mention

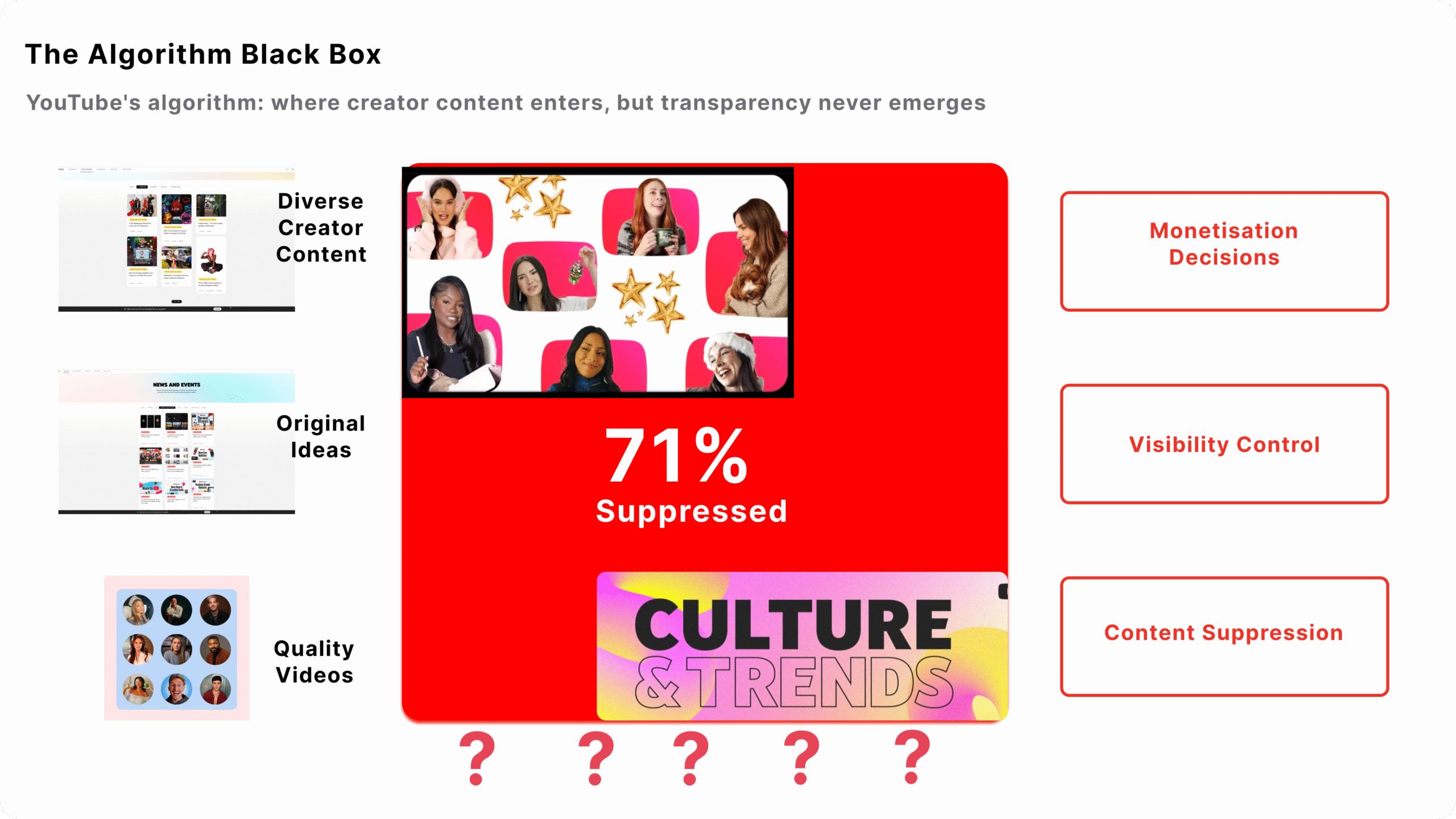

Speaking of which: YouTube’s 2025 culture report mentions “algorithm” exactly zero times in its regional analyses.

This omission isn’t accidental. It’s the report’s foundational sleight of hand.

Every success story YouTube celebrates—Mexican creator boxing events drawing 2 million concurrent viewers, Indonesian “hipdut” music reaching global audiences, French creators launching 900km livestreamed walks—exists only because YouTube’s algorithm amplified it. The algorithm determines what gets recommended, who gets discovered, which formats succeed, and which creators die in obscurity despite brilliant content.

71% of Harmful Videos Were Actively Recommended

Independent research reveals what YouTube won’t discuss. Mozilla’s 2021 investigation found that 71% of “regrettable” videos—content users later reported as misleading, violent, or hateful—were actively recommended by YouTube’s algorithm. Not searched for. Recommended. Videos violating YouTube’s own policies accumulated 160 million views before removal.

The algorithm prioritises engagement and watch time over content quality or societal benefit. It’s opaque even to the engineers who built it. Neural networks adapt in ways developers can’t fully explain. Creators can’t opt out. Users can’t see why they’re being shown specific content.blog

Yet YouTube’s culture report attributes creator success exclusively to innovation, format experimentation, and audience connection. As if the algorithm—the single most powerful force shaping what 2 billion users see—doesn’t exist.

This erasure serves YouTube’s interests perfectly. Acknowledging algorithmic control would undermine the meritocracy myth the entire report constructs: that good creators succeed through talent and hustle, that audiences freely choose what they watch, that YouTube simply provides neutral infrastructure.

The reality?

The algorithm is the infrastructure. And YouTube owns it, tunes it, and profits from it—while creators and audiences remain subjects of an attention-extraction machine they can’t see, understand, or influence.

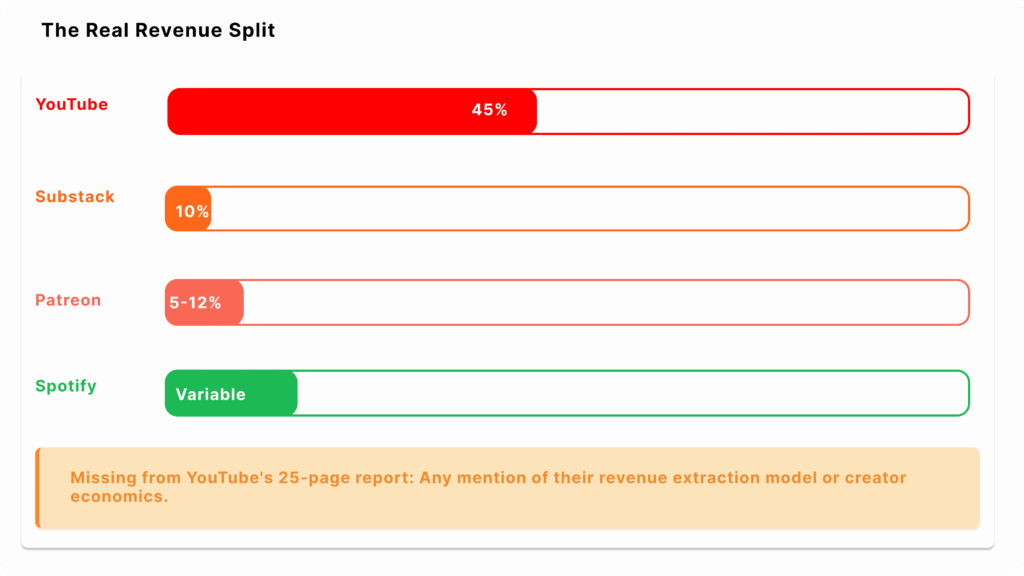

The 45% Nobody Talks About

Here’s another figure missing from YouTube’s 25-page culture report: 45%.

That’s YouTube’s cut of creator ad revenue.

For every $100 in ads running on a creator’s video, YouTube takes $45.

For Super Chats and channel memberships—the “direct-to-fans” revenue streams the report celebrates—YouTube takes 50%.

Compare this to Substack (10%), Patreon (5-12%), or even Spotify (varies by deal but generally more favorable to artists).

YouTube’s cut is among the highest in the creator economy, yet it’s completely absent from a report supposedly analysing the forces “shaping the future of creativity.”

The report positions creators as “new broadcasters” and “cultural architects.” Academic researchers use different language: gig workers “at the mercy of opaque algorithms.” Scholars studying platform capitalism describe YouTube as an “extractive apparatus” practicing “epistemic dispossession”—appropriating creators’ labor, knowledge, and social relationships while directing profits to shareholders.business.google

YouTube even removed public disclosure of which channels receive ad revenue in November 2023, increasing monetisation opacity right as the creator economy professionalised. Creators frequently report videos demonetised “for ambiguous or inconsistent reasons” with appeals processes lacking meaningful oversight. quasa

But YouTube’s culture report frames everything through “community,” “connection,” and “co-creation”—language that masks extractive economic relationships as mutual value creation. The U.S. section celebrates “direct-to-fans” formats where creators “give fans a sense of agency.” What it doesn’t mention: YouTube mediates every interaction, collects data on every engagement, and can unilaterally change algorithmic visibility without explanation or recourse.

The “direct” connection exists only within a platform-controlled environment designed to extract maximum value from both creators and audiences.

Much like Google’s advertising panic reveals how platforms respond when their control slips—scrambling to inflate prices and maintain dominance—YouTube’s report is a pre-emptive strike against acknowledging that control exists.thinkwithgoogle

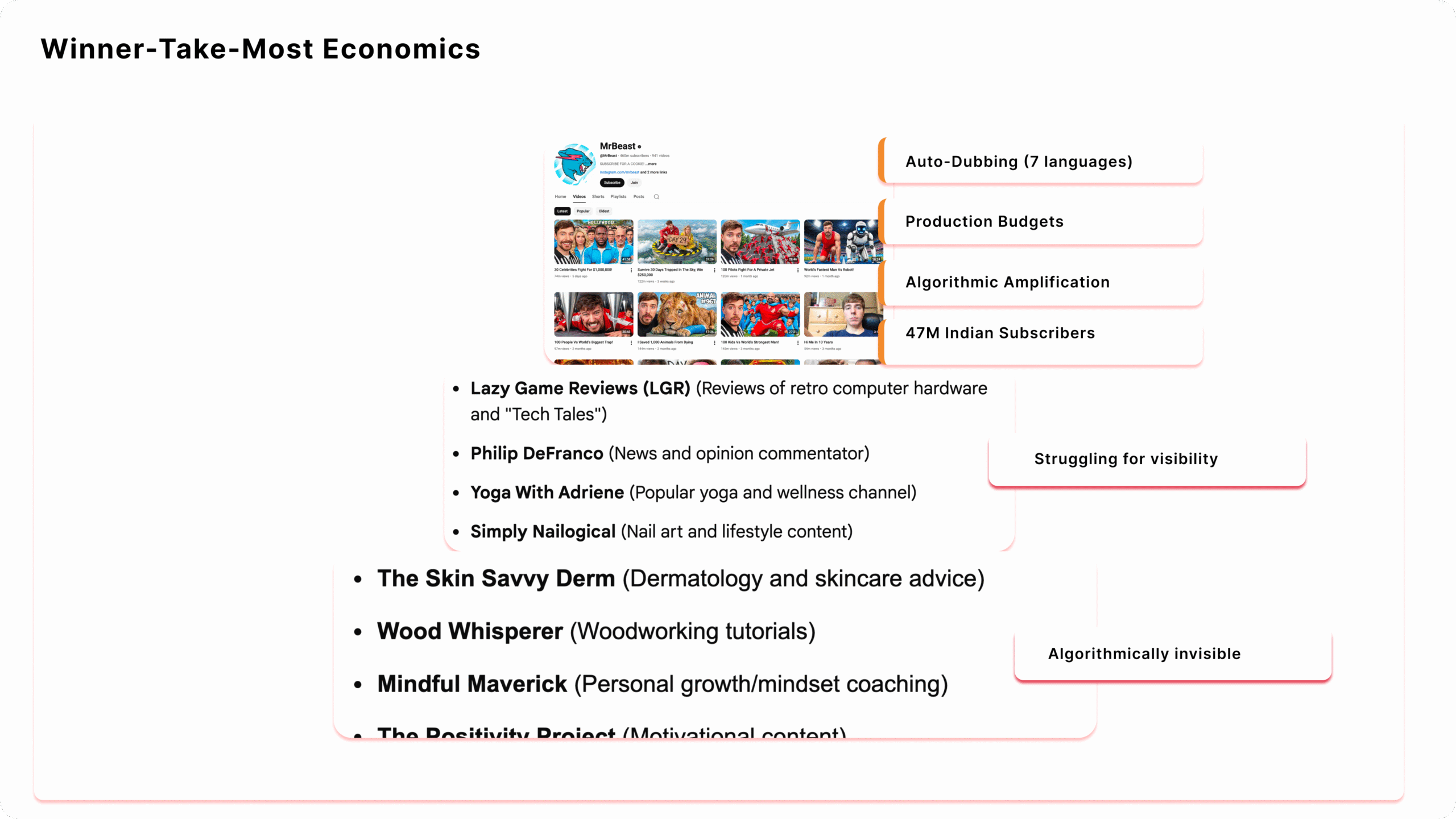

MrBeast, or the Winner-Take-Most Economy

MrBeast appears in the top creators list for 10 of 12 markets YouTube analysed. The report attributes this to auto-dubbing technology making content accessible across languages—MrBeast gained 47 million subscribers from India alone through seven-language dubs.

YouTube frames this as democratising reach. Look closer and you’ll see it’s actually platform consolidation.

Auto-dubbing isn’t a neutral tool. It’s infrastructure that rewards creators who can produce expensive, highly-produced content at massive scale—content that benefits most from platform-provided technology. This creates a winner-take-most ecosystem where a handful of heavily capitalised creators (MrBeast operates with millions in production funding) dominate global attention.

Meanwhile, the report simultaneously celebrates “emerging” regional creators who lack comparable resources. Indonesian creators developing “hipdut” music fusion. Mexican creators launching live reality shows. Middle Eastern creators tapping into horror gaming fandoms.

These aren’t contradictions in YouTube’s strategy—they’re features. The platform needs both: mega-creators who drive mainstream advertiser comfort, and long-tail creators who provide the “authentic” local content that keeps diverse audiences engaged. The culture report packages both as success stories while obscuring how platform economics systematically advantage the already-successful.

The dubbing example also reveals how YouTube frames technological dependency as creator empowerment. Auto-dubbing locks creators deeper into platform infrastructure. YouTube captures the value from global reach. But the report celebrates it as YouTube “helping” creators—a framing that erases power asymmetries in favour of benevolent-platform mythology.

What Marketers Are Actually Buying

So why does YouTube produce this report? And why do marketers lap it up?

Follow the money.

YouTube’s ad revenues hit $8.1 billion in Q1 2024—a 21% year-over-year increase. The platform is in fierce competition with TikTok, Instagram, and traditional media for brand budgets. Culture reports aren’t anthropology—they’re sales collateral.

Every insight YouTube provides—”cross-border fandoms shape culture,” “audiences seeking virtual escapes,” “Gen Z wants content made for them”—directly addresses advertiser concerns. The report tells brands: our platform delivers engaged global audiences ready for “co-creation” partnerships. Translation: receptive to sponsored content camouflaged as authentic creator expression.

The regional breakdowns provide even more value: localised insights for “scaling” campaigns. Want to reach Korean audiences? Target “effort premium” content where creators undertake demanding challenges. German market? Build “third place” community experiences. Brazil? Leverage “gamified lives” and “shared universe” creator houses.

These aren’t cultural observations—they’re targeting strategies packaged as trend analysis. Similar to how Swiggy Wiggy 3.0 demonstrated authentic people-powered marketing—turning delivery partners into brand heroes rather than invisible labor—YouTube wants brands to believe their platform enables that same connection while obscuring how algorithmic mediation fundamentally changes the relationship. Yet where Swiggy celebrated workers with genuine voice and agency, YouTube’s “creator celebration” keeps that voice mediated and controlled.business.google

And it’s working. YouTube’s first Brand Pulse Report (October 2025) found creators drive higher brand consideration than traditional ads. Marketers increasingly view creator partnerships as more effective than display advertising. YouTube’s culture report provides the intellectual scaffolding to justify those budget shifts—while ensuring those budgets flow through YouTube’s 45% tollbooth rather than direct creator-brand relationships.

The report also serves reputation management. Growing regulatory scrutiny around algorithmic harm, content moderation failures, and platform monopolization threatens YouTube’s business model. By emphasizing creator success, cultural diversity, and community connection, the report constructs a counter-narrative: YouTube as culture-enabler, not attention-extraction machine.

It’s propaganda in the classic sense—not crude disinformation, but strategic narrative construction that serves institutional interests while claiming to document objective phenomena.

The Contradictions Speak Volumes

Sometimes the report’s own contradictions reveal what it’s trying to hide.

The UK analysis celebrates “unexpected growth of long-form video,” arguing viewers seek “more profound and insightful content, perhaps precisely in reaction to the feeling of surface level information.”

Wait—isn’t YouTube aggressively pushing Shorts to compete with TikTok? Didn’t the platform spend years optimising for watch time and engagement, systematically favouring algorithmically-optimised entertainment over educational content? Aren’t creators constantly pressured to produce more, faster, shorter?

The long-form “resurgence” isn’t a trend YouTube enabled—it’s audience rebellion against platform-dictated formats. Creators like Gary’s Economics (30+ minute economic explainers) and Madeline Argy (40+ minute discussions of feminism and imposter syndrome) succeed despite YouTube’s historical incentives, not because of them.

The report presents this as another trending format, as if creator choice rather than audience exhaustion drives the shift. It can’t acknowledge that users might be tired of algorithmically-optimised content extraction—that would undermine the entire document’s premise.

Similarly, the Brazil section celebrates creators “gamifying daily lives” and building “shared universes” where “fans become digital biographers.” This frames surveillance and data collection as participatory culture. Creators transform mundane activities into content not because of creative vision but because platform economics demand constant production. Fans track creator relationships because YouTube’s recommendation algorithm rewards obsessive engagement.

The report repackages exploitation as innovation.

What a Transparent Report Would Include

Imagine YouTube published actual transparency metrics:

- Percentage of creators earning minimum wage from platform revenue

- Average time from channel start to monetization eligibility

- Algorithmic suppression rates for different content categories

- Appeals success rates for monetization and content decisions

- Revenue distribution captured by top 1%, 5%, 10% of creators

- Detailed methodology for trending topic selection and weighting

- Data on how algorithm changes affect creator revenue

- Content moderation error rates and demographic disparities

This data exists within YouTube’s systems. Its absence isn’t oversight—it’s editorial choice revealing the document’s actual purpose.

The methodology section offers strategic ambiguities instead. “Trending Topics” are “based on analysis by YouTube Culture & Trends team of variety of signals including views, uploads, creator activity”—no transparency about weighting, thresholds, or algorithmic factors. Topics qualify for inclusion based on “conspicuous popularity”—subjective determination by YouTube employees, not objective metrics.

The “trends” aren’t discovered. They’re curated.

What Marketers Should Do Instead

If you’re making creator economy decisions based on YouTube’s culture report, you’re getting a carefully managed version of reality designed to serve YouTube’s interests, not yours.

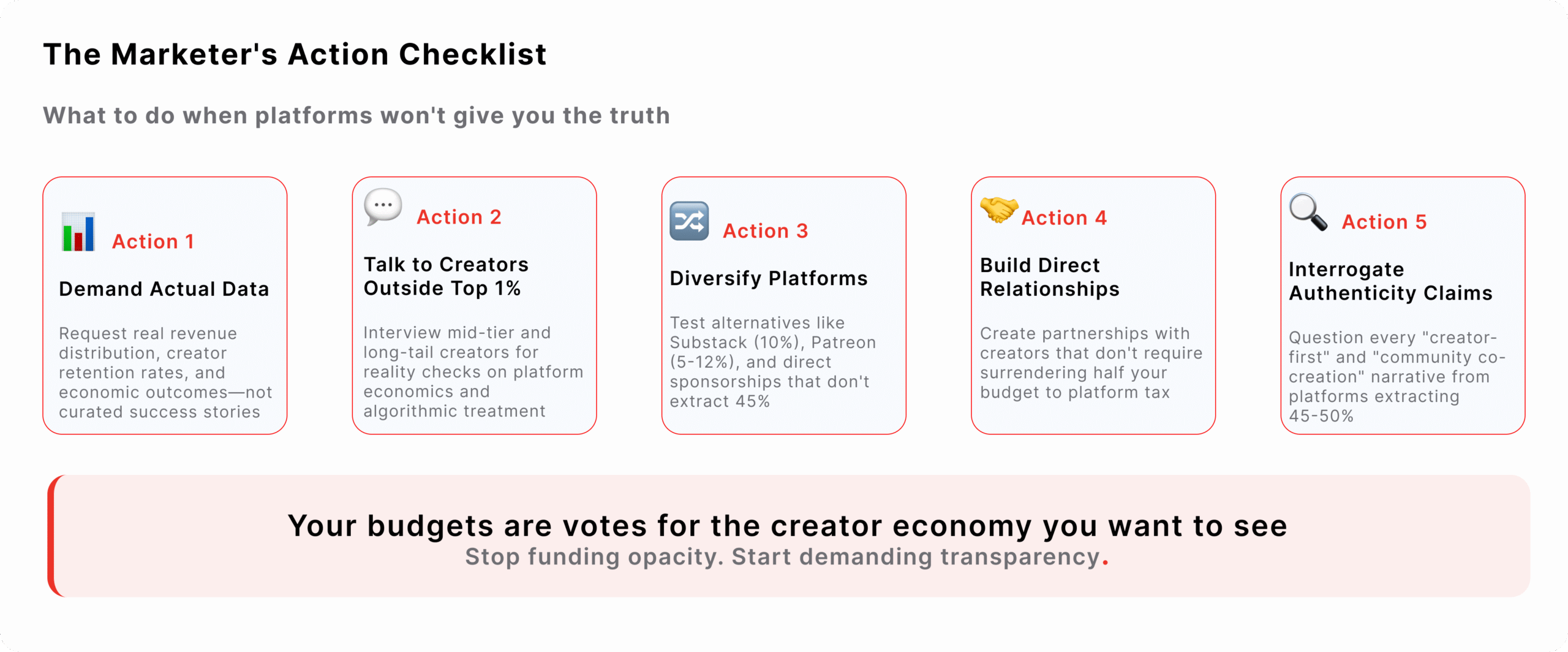

First, demand actual data. Revenue distribution. Algorithmic visibility changes. Monetisation approval rates. Content moderation consistency. Creator retention metrics. If YouTube wants you to spend millions on its platform, it should provide transparency beyond cherry-picked success stories.

Second, talk to creators directly—especially those outside the top 1%. Ask about demonetisation. Algorithm changes. Revenue volatility. Platform dependency. The stories you’ll hear differ dramatically from YouTube’s narrative. Small and mid-tier creators experience the platform as precarious, opaque, and extractive. Compare that to how Nike’s Why Do It campaign actually let creators speak for themselves—user-generated content and genuine voices rather than platform-mediated narratives.youtube

Third, diversify platforms aggressively. YouTube’s culture report wants you to believe it’s the inevitable infrastructure for digital video. It’s not. TikTok, Instagram, Substack, Patreon, and direct creator websites all offer alternatives with different economics and power dynamics. Don’t let platform dependency eliminate your negotiating leverage.

Fourth, build direct creator relationships when possible. YouTube’s 45% cut only makes sense if the platform provides irreplaceable value. Often it doesn’t. For established creators with proven audiences, direct sponsorships eliminate the platform tax while giving you better data and creative control.

Fifth, interrogate “authenticity” claims ruthlessly. When a creator’s brand integration feels “authentic,” ask whether that’s genuine or algorithmic performance art. The creator economy’s authenticity crisis means surface markers of realness often mask highly commercialized content. Your brand risks association with that contradiction. Look at Google’s DigiKavach campaign—when cultural intelligence actually serves audience education rather than platform profit extraction—or Amazon’s Five Star Theater, which celebrates real customer voices without mediation.youtube

As Anthropic’s Claude marketing demonstrates, the most sophisticated campaigns now show less product and more experience—a strategy YouTube’s report mimics while selling the opposite. The question isn’t whether YouTube’s trends are real. It’s whether YouTube’s framing serves your interests or theirs.blog

Platform Economics Beyond the Algorithm

The fundamental issue YouTube’s report obscures: creator economy success isn’t meritocratic. It’s algorithmically determined and extractively structured. The platform’s revenue model ensures that 45% of every ad dollar flows upward regardless of creator struggle.

This connects to broader patterns in platform capitalism. YouTube isn’t unique—Meta, TikTok, Instagram all employ similar extraction mechanisms masked by rhetoric about “empowerment” and “community.” But YouTube’s culture report is particularly sophisticated because it claims to be analytical documentation rather than explicit promotional material.

The report’s regional analysis of food delivery marketing innovations through Swiggy’s employee advocacy shows how other platforms handle creator/worker representation differently—celebrating workers as people rather than as data points feeding algorithmic systems.hypebot

The Larger Pattern

YouTube’s culture report isn’t unique. Every major platform publishes similar documents—Meta’s “State of Small Business,” TikTok’s “What’s Next” reports, LinkedIn’s thought leadership. All serve dual purposes: sales collateral for advertisers and reputation management for regulators.

These reports share common features: celebration of user success stories, emphasis on platform’s cultural relevance, complete erasure of power asymmetries and extractive economics, strategic ambiguity around methodology and metrics.

Read them as institutional communications, not neutral research. Ask what they’re not saying. Follow the money. Consider whose interests the narrative serves. The marketing critique landscape is full of case studies in brand messaging that reveal similar patterns—KitKat’s musical breaks, Maybelline’s Mumbai mirage, Nike’s purpose-first positioning—all performing authenticity while serving shareholder interests.forbes

Platform capitalism depends on constructed narratives that naturalise extraction as empowerment, surveillance as community, and algorithmic control as neutral infrastructure.

Culture reports are simply the most polished version of that narrative construction.

YouTube’s 2025 report is genuinely insightful about format innovation, cross-cultural exchange, and emerging content types. Those observations are real. But they’re embedded in a larger story that serves YouTube’s interests while obscuring the algorithm opacity, revenue extraction, content moderation failures, and labor precarity that define the actual creator experience.

Email Marketing Lessons from YouTube’s Propaganda

Interestingly, YouTube’s approach mirrors sophisticated email campaign strategy. Just as email sequences work best when they build trust before selling, YouTube’s culture report builds credibility before the sales pitch: “Look how wonderful creators are thriving on our platform. Now give us your ad budget.”youtube

The difference is ethical intentionality. Well-designed email campaigns serve subscriber interests alongside business goals. YouTube’s report serves only platform interests while claiming neutrality. As creator strategist Gord Isman notes in his analysis of YouTube’s 20-year report, the platform is increasingly transparent about monetisation momentum and global reach—yet this transparency obscures the extractive mechanisms that underpin those opportunities.

The Bottom Line

The question for marketers isn’t whether to believe YouTube’s trends. It’s whether to accept YouTube’s framing of what those trends mean, who they benefit, and what economic relationships they naturalise as inevitable features of digital culture rather than constructed choices advantaging platform shareholders at creator and audience expense.

Your advertising budgets are votes. Spend them accordingly.

Sources

- Amazon Five Star Theater: Why Authenticity Wins

- Mozilla Foundation, “YouTube Algorithm Investigation”

- Diggit Magazine, “The YouTube Algorithm and Its Problems”

- AI Law Blog, “Tang on Creative Labor and Platform Capitalism”

- Wired, “YouTube Hiding Channel Ad Revenue”

- Google’s Advertising Panic Reveals CPC Crisis

- Brand Anthem in the Age of Algorithms: Swiggy Wiggy 3.0 Campaign

- Why “Why Do It?” Is Nike’s Most Intriguing Invitation to Date

- Google DigiKavach Campaign Analysis: When Television’s Detectives Fight Digital Crime

- Selling AI Without Showing Product: Claude as Thinking Partner

- Food Delivery Marketing Archives

- Marketing Critique Archives

- Email and Campaigns: High-Converting Copy That Converts

- Gord Isman, “5 Creator Insights Hidden in YouTube’s 20-Year Report” (YouTube, August 2, 2025)

- Google, “YouTube’s 2025 Trends and Your Recap”

- Think with Google, “Top YouTube Trends to Know for 2025” (India edition)

- Quasa.io, “YouTube’s 2025 Culture & Trends Report: Creators Go Global, IRL and Unfiltered”

- Think with Google, “Neal Mohan’s YouTube Predictions for 2025”

- Think with Google, “Top YouTube Trends to Know for 2025” (US edition)

- “8 Trends YouTube’s 2025 Report Reveals About Creator Growth” (YouTube video)

- Fast Company, “The Creator Economy Is Facing an Authenticity Crisis”

- 5 Creator Insights Hidden in YouTube’s 20-Year Report — Gord Isman (YouTube, August 2, 2025)

- YouTube’s 2025 Trends and Your Recap — Google Official Blog

- Top YouTube Trends to Know for 2025 — Think with Google (India edition)

- YouTube’s 2025 Culture & Trends Report: Creators Go Global, IRL and Unfiltered — Quasa.io

- Neal Mohan’s YouTube Predictions for 2025 — Think with Google

- Top YouTube Trends to Know for 2025 — Think with Google (US edition)

- 8 Trends YouTube’s 2025 Report Reveals About Creator Growth — YouTube video

- What I Earned from YouTube in 2025 — And My 2026 Plan — YouTube video

- New Report Unpacks a 20 Year Entertainment Revolution — YouTube Official Blog

- YouTube Culture & Trends Report 2024 — HypeBot (PDF)

- YouTube Growth Strategies That Work in 2025 According to Top Channels — Forbes

- YouTube Culture & Trends Reports — YouTube Official Trends Hub