In the vast expanse of India’s digital universe—where a carpenter in Coimbatore might watch the same workout video as a software engineer in Gurgaon—Larry Wheels, possessing the singular ability to deadlift weight equivalent to a compact car, found himself attempting to navigate the peculiar phonetics of Hindi cinema dialogue.

The occasion represented neither cultural exchange nor athletic demonstration, but rather something far more intriguing: the convergence of global fitness authority with a nation’s emerging obsession with physical transformation, mediated through the unlikely vehicle of protein powder marketing.

The resulting campaign, “PROTEIN THALA,” serves as more than celebrity endorsement—it functions as a cultural artifact of contemporary India’s relationship with wellness, where traditional dietary wisdom encounters Silicon Valley biohacking, where ancient yogic practices share space with Instagram-worthy gym culture, and where the language of strength must somehow accommodate the sensibilities of a billion-person democracy still discovering its relationship with systematic fitness.

The Architecture of National Transformation

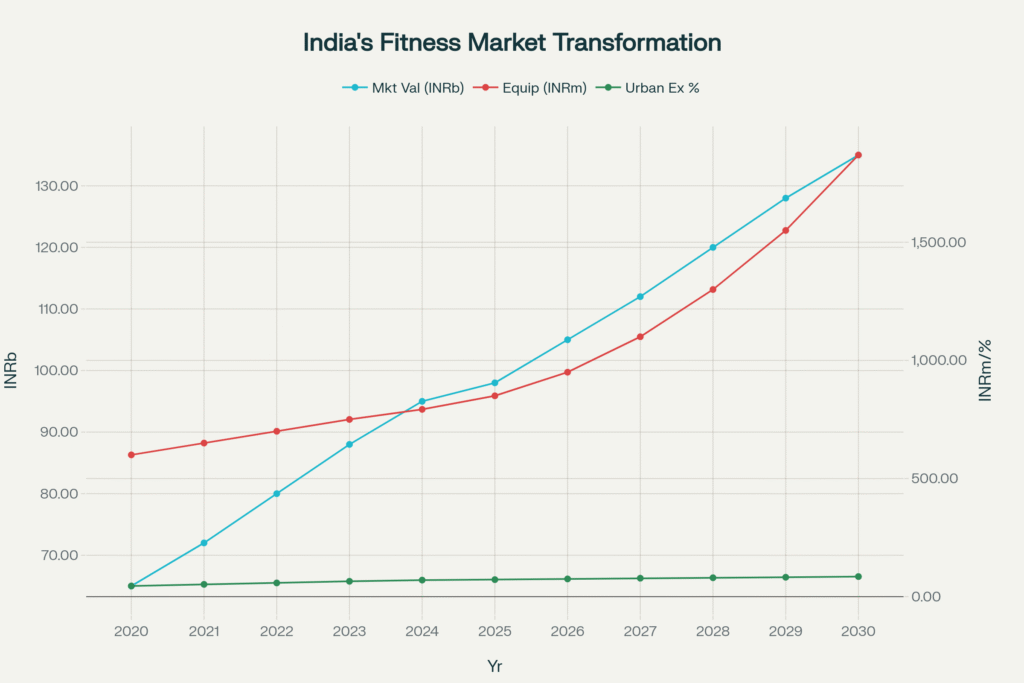

To understand the campaign’s significance requires acknowledging India’s position within a global fitness revolution that has particular resonance in a country experiencing unprecedented prosperity. The numbers tell a remarkable story: India’s fitness market, valued at ₹98 billion in 20251, reflects not merely economic growth but a fundamental shift in how the world’s most populous nation conceives of health, success, and self-improvement. This represents a civilisation-level transformation, occurring with the speed characteristic of digital-age cultural change.

India’s Fitness Market Growth: A visual representation of the fitness market’s explosive growth from ₹65 billion in 2020 to ₹98 billion in 2025, alongside equipment sales and urban exercise recognition trends.

The statistics reveal the scope of this metamorphosis. The fitness industry witnessed a 50% surge in service providers post-pandemic, while equipment sales expanded from ₹792.70 million in 2024 to a projected ₹1,869.15 million by 2033.

Perhaps most tellingly, 72% of urban Indians now recognize the benefits of regular exercise3—a percentage that would have seemed implausible in the India of even a decade ago, when fitness culture remained largely confined to metropolitan elite circles.

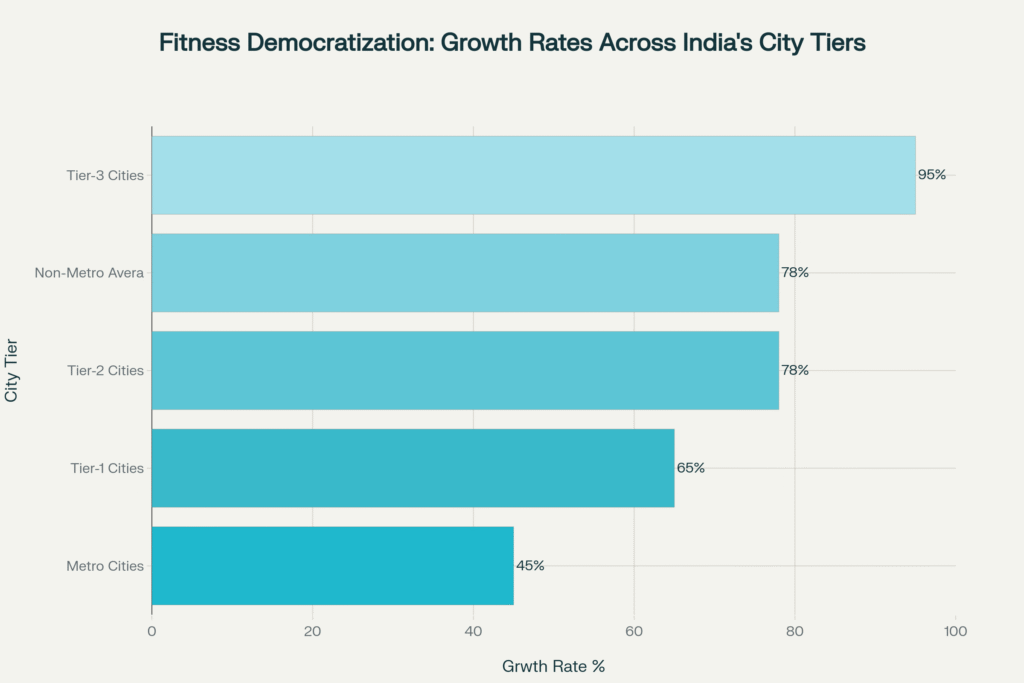

This transformation extends beyond urban boundaries with remarkable velocity. Non-metro cities demonstrated an impressive 78% average growth in fitness centers2, suggesting that the fitness renaissance has achieved something rare in Indian cultural adoption: simultaneous penetration across economic and geographical divides. Cities like Howrah recorded 150% growth in fitness listings2, while the proliferation of gyms now reaches approximately 96,000 registered facilities nationwide4.

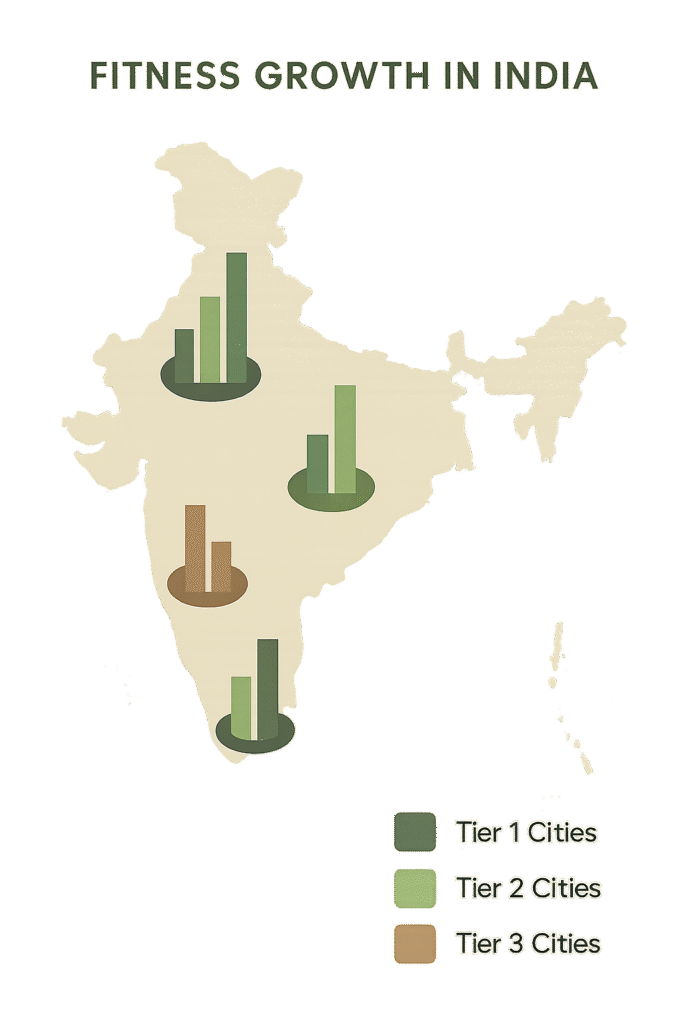

Fitness Center Growth by City Tier: Non-metro and smaller cities are driving India’s fitness revolution, with Tier-3 cities showing 95% growth compared to 45% in metro areas

The Semiotics of Supplemental Consumption

What renders the “PROTEIN THALA” campaign particularly fascinating from a cultural perspective is its approach to what might be termed “nutritional authenticity anxiety”—a distinctly Indian concern rooted in the country’s complex relationship with foreign food products and traditional dietary practices. This anxiety manifests itself in a market where consumers have learned to scrutinize protein content claims, batch numbers, and certification credentials with the diligence typically reserved for investment decisions.

The campaign’s emphasis on MuscleBlaze’s U.S. Patent for EnzymePro formulation addresses this concern directly, speaking to a consumer base that values scientific legitimacy while remaining skeptical of marketing hyperbole. In a market where recent studies revealed that the majority of protein supplements failed to contain labeled protein content5, and where aflatoxins were detected in plant-based proteins5, the promise of verified authenticity carries particular weight.

This preoccupation with authenticity reflects India’s broader cultural negotiation with globalization. The protein supplement market’s growth—from ₹1.40 billion in 2024 to a projected ₹1.88 billion by 20296—occurs within a context where 73% of Indians remain protein deficient7, creating a unique market dynamic where genuine nutritional need meets justified skepticism about product claims.

The Cultural Mechanics of Pan-Indian Appeal

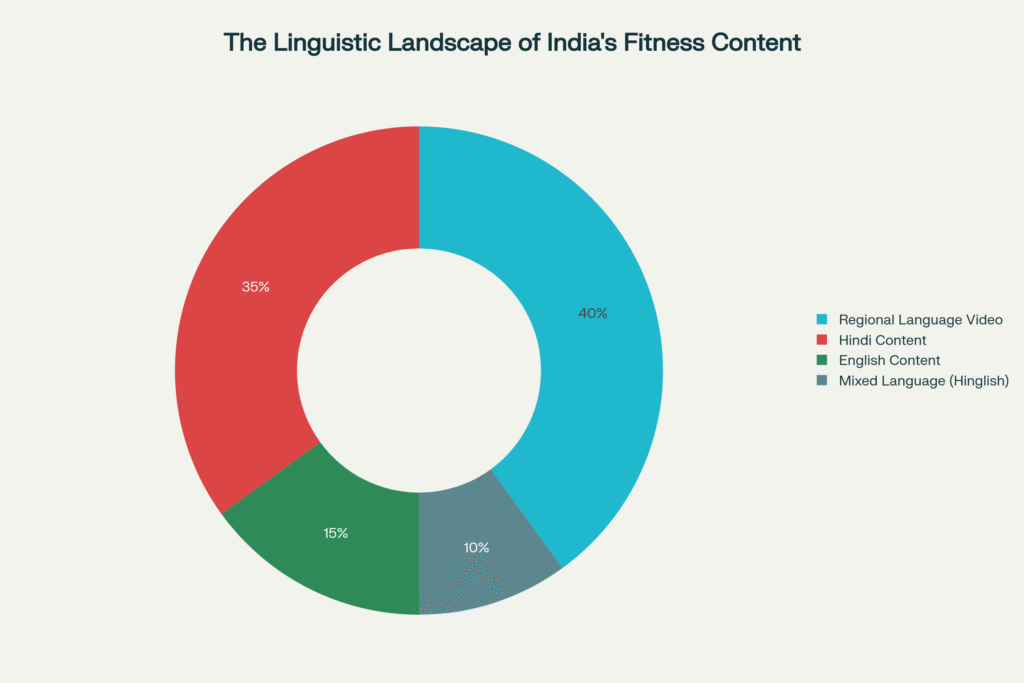

Perhaps most intriguingly, the campaign’s success depends on its ability to navigate India’s linguistic and cultural complexity while maintaining broad appeal across diverse demographic segments. The Hinglish approach—that distinctive admixture of Hindi and English characterizing much contemporary Indian discourse—represents more than linguistic convenience; it functions as cultural bridge-building in a nation where regional identity coexists with national aspiration.

Language Content Consumption in Indian Fitness: Regional language content leads at 40%, followed by Hindi (35%), demonstrating the importance of multilingual fitness communication

This linguistic strategy acknowledges a fundamental reality of contemporary India: the emergence of a pan-Indian fitness culture that transcends traditional regional boundaries.

Unlike previous cultural phenomena that spread slowly from metropolitan centers, fitness consciousness has achieved what might be termed “simultaneous adoption” across India’s diverse landscape, facilitated by digital connectivity and shared aspirational content.

The data supports this observation. Regional language content now comprises over 40% of video consumption8, with fitness influencers achieving significant followings by delivering multilingual content that accommodates India’s linguistic diversity while maintaining universal fitness messaging. The success of creators like Ranveer Allahbadia (BeerBiceps) with 8 million YouTube subscribers9 demonstrates the viability of pan-Indian fitness content that respects regional sensibilities while promoting universal wellness principles.

The Economics of National Aspiration

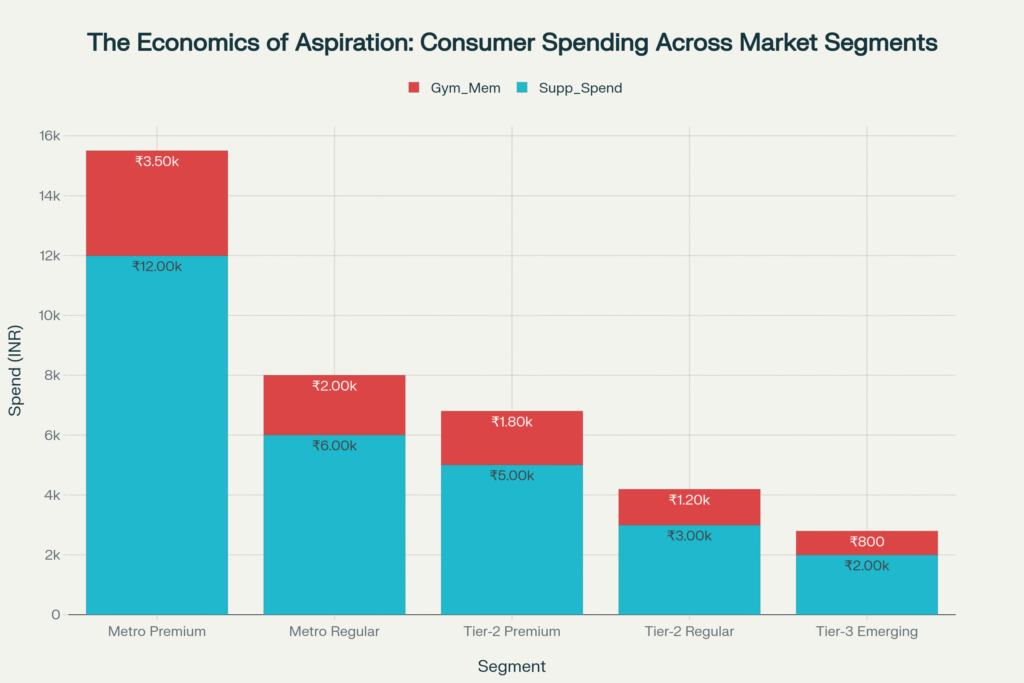

Consumer Spending Patterns Across Market Segments: Premium metro consumers spend ₹12,000 monthly on supplements, while tier-3 consumers represent emerging market potential at ₹2,000

The protein supplement market’s expansion cannot be divorced from India’s broader economic transformation and the emergence of what economists term “aspirational middle-class consumption.” The willingness to invest in premium supplements—where products like MuscleBlaze’s Biozyme Whey command approximately ₹3,199 for 2kg10—represents a significant shift in household spending priorities across economic segments.

This transformation manifests differently across India’s economic geography. While metropolitan consumers might spend ₹10,000 to ₹12,000 monthly on protein supplements10, tier-2 and tier-3 cities demonstrate growing comfort with the ₹2,000-₹3,000 price range10 that once seemed prohibitive. The athleisure market’s expansion into smaller cities—with CAGR of 5.70% during 2024-203211—suggests a fundamental shift in how Indians across economic strata prioritize fitness-related spending.

The emergence of what might be called “democratic fitness consumption” reflects broader changes in Indian society’s relationship with health and status. Unlike previous luxury categories that remained confined to urban elite, fitness consumption has achieved remarkable penetration across India’s economic spectrum

All of this is obviously facilitated by digital payment systems and e-commerce accessibility that have democratised premium product access.

The Question of Cultural Authenticity

Yet the campaign also illuminates certain tensions inherent in India’s fitness transformation. The entertainment-focused approach risks underestimating an increasingly sophisticated consumer base that possesses both educational background and disposable income sufficient to demand more substantive information about nutrition science and training methodology.

This disconnect becomes particularly apparent when considering India’s emergence as a technology-driven market where consumers demonstrate increasing comfort with evidence-based decision-making. The success of fitness tracking technology—with the fitness tracker market growing at 19.8% CAGR to reach ₹7,656.1 million by 203012—suggests audiences ready for more sophisticated approaches to fitness communication than celebrity entertainment typically provides.

The campaign’s reliance on borrowed authority—Larry Wheels’s documented strength lending credibility to MuscleBlaze’s claims—may prove less durable than approaches that combine entertainment value with substantive consumer education.

Given that Bollywood celebrities spend ₹2-5 lakh monthly on fitness13, the gap between celebrity fitness investment and average consumer reality might undermine long-term authenticity perceptions.

The Evolution of Regional Inclusivity

The campaign’s success ultimately depends on its ability to speak simultaneously to India’s diverse regional cultures while maintaining coherent brand messaging. Regional language content now accounts for 60% of television consumption and 50% of streaming video consumption14, indicating consumer preference for culturally resonant content that acknowledges local sensibilities.

Yet fitness culture has achieved something remarkable in contemporary India: the creation of shared aspirational language that transcends regional boundaries. The proliferation of fitness influencers across linguistic communities—from Tamil fitness content creators to Bengali wellness advocates—demonstrates the emergence of what might be termed “pan-Indian fitness vocabulary” that accommodates regional preferences while maintaining universal appeal.

This phenomenon reflects broader changes in Indian cultural consumption patterns, where regional identity coexists with national aspirations in ways that previous generations found difficult to navigate. The fitness revolution has provided a cultural framework where regional pride and national modernity reinforce rather than conflict with each other.

The Future of Inclusive Wellness Marketing

The “PROTEIN THALA” campaign ultimately poses questions about the evolution of consumer marketing in a nation experiencing rapid economic and cultural transformation. As India’s fitness culture matures—evidenced by the emergence of specialized training methodologies and sophisticated supplement consumption patterns—the country may represent a testing ground for more nuanced approaches to wellness marketing that respect regional diversity while promoting universal health principles.

The campaign’s reception will likely influence how international fitness brands approach not only India but other culturally complex markets where authentic engagement requires navigation of linguistic, economic, and cultural diversity. Success in such markets demands more than celebrity endorsement; it requires genuine understanding of how global wellness trends adapt to local cultural contexts while maintaining scientific credibility.

Perhaps the deeper question is whether campaigns like “PROTEIN THALA” represent a transitional phase in global fitness marketing—a bridge between celebrity-driven consumption and evidence-based choice that acknowledges cultural diversity while promotinsystematic wellnessg universal wellness principles.

India, with its unique combination of technological sophistication, cultural complexity, and emerging affluence, provides an ideal laboratory for answering this question.

As the sun sets over the diverse landscape of modern India—from the tech parks of Bangalore to the emerging fitness centers of Indore, from the traditional akhadas of Delhi to the modern gyms of Kochi—the real test of campaigns like “PROTEIN THALA” will be whether they evolve beyond entertainment value to serve the genuine educational needs of a nation rapidly becoming one of the world’s most sophisticated fitness markets.

In the end, Larry Wheels’s attempt to pronounce Hindi phrases may matter less than whether his documented expertise can contribute to lasting consumer education across India’s diverse cultural landscape—a different sort of heavy lifting that acknowledges both the complexity and the aspirations of a billion people discovering their relationship with systematic wellness.

The true measure of success will be whether such campaigns can honor India’s cultural diversity while promoting the universal human aspiration for health, strength, and vitality.

Sources:

- https://www.imarcgroup.com/india-fitness-equipment-market

- https://www.bwhealthcareworld.com/article/justdial-reports-50-surge-in-fitness-service-providers-post-pandemic-across-india-524122

- https://www.kenresearch.com/industry-reports/india-fitness-market

- https://fashionablefoodz.com/fitness-management-in-2025-has-become-more-personalized-and-data-driven-than-ever-before/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC10994440/

- https://www.mordorintelligence.com/industry-reports/india-protein-market

- https://www.dezerv.in/blog/indias-protein-boom/

- https://www.entrepreneur.com/en-in/news-and-trends/over-40-video-content-is-consumed-in-regional-language/343653

- https://blog.hoopr.ai/best-indian-fitness-influencers-in-2025/

- https://www.agriculturaljournals.com/archives/2025/vol7issue3/PartA/7-2-27-741.pdf

- https://www.adgully.com/how-tier-2-and-tier-3-cities-are-driving-high-growth-in-athleisure-market-in-india-152615.html

- https://www.grandviewresearch.com/horizon/outlook/fitness-tracker-market/india

- https://economictimes.com/magazines/panache/how-much-do-bollywood-celebs-spend-on-fitness-cost-revealed-by-sonu-sood-tamannaah-bhatias-trainer/articleshow/118452376.cms

- https://www.languageservicesbureau.com/blog/Regional-Languages-in-Todays-Marketing-World.php

- https://www.ndtvprofit.com/business/protein-consumption-by-indians-is-more-than-advisable-says-report

- https://www.grandviewresearch.com/horizon/outlook/virtual-fitness-market/india

- https://www.grandviewresearch.com/industry-analysis/india-nutritional-supplements-market-report

- https://burnlab.co/blogs/news/30-interesting-fitness-statistics-india-2022

- https://www.expertmarketresearch.com/reports/indian-sports-and-fitness-goods-market

- https://aguante.in/blogs/activewear-news/local-activewear-shapes-indias-fitness-culture

- https://www.india-briefing.com/doing-business-guide/india/sector-insights/the-fitness-industry-in-india-investment-outlook-after-covid-19

- https://in-focusindia.com/featured/the-rise-of-indias-fitness-culture/

- https://www.statista.com/outlook/cmo/footwear/gym-training/india

- https://iismworld.com/wp-content/uploads/2024/04/Deep-Insights-on-Indian-Fitness-Trends.pdf

- https://www.researchandmarkets.com/reports/5753378/indian-sports-fitness-goods-market-report

- https://www.marketbrew.in/weekly-insights/protein-market-india

- https://hobo.video/blog/how-3-fitness-brands-are-dominating-influencer-marketing-in-india/

- https://hobo.video/blog/top-10-influencer-marketing-strategies-for-fitness-business-on-youtube-in-india-strategies-by-hobo-video/

- https://nitrro.in

- https://reputationtoday.in/importance-of-regional-content-marketing/

- https://www.themediaant.com/blog/top-10-fitness-influencer-agencies-india/

- https://zeezest.com/culture/into-a-fitter-world-7-celebrity-owned-and-backed-wellness-ventures-on-our-radar-4245

- https://vavodigital.com/indian-women-fitness-influencers/

- https://timesofindia.indiatimes.com/blogs/voices/six-reasons-why-regional-language-content-boomed-during-the-pandemic/

- https://ottinfluence.com/influencer-marketing-for-fitness-brands/

- https://www.justdial.com/list/inside-the-world-of-celebrity-trainers-unveiling-top-7-celebrity-trainers-and-their-secrets?wkwebview=1

- https://granth.in/vernacular-content-consumption-in-new-india/

- https://vhub.ai/influencer-marketing-in-athleisure-industry-2025/

- https://www.instagram.com/yasminkarachiwala/

- https://atomcomm.in/regional-language-content-indian-digital-campaigns/

- https://manthangajjar.in/top-indian-influencer-marketing-trends-to-watch/

- https://www.linkedin.com/pulse/regional-language-gamechanger-driving-sports-viewership-emerging

- https://www.hercircle.in/engage/get-inspired/trending/how-india-is-closing-the-health-gap-in-rural-areas-8953.html

- https://www.getdistributors.com/muscleblaze-whey-protein-distributors.html

- https://paa2014.populationassociation.org/papers/143090

- https://dir.indiamart.com/impcat/muscleblaze-protein-supplement.html?biz=30

- https://cdn.visionias.in/value_added_material/9efc8-beyond-metros–the-ascent-of-indias-tier-2-and-tier-3-cities.pdf

- https://pmc.ncbi.nlm.nih.gov/articles/PMC4649886/

- https://www.panelplace.com/products/muscle-blaze/4123

- https://www.dqindia.com/tier-2-tier-3-cities-proving-growth-engines-india/

- https://epubs.icar.org.in/index.php/IJEE/article/view/131855

- https://www.muscleblaze.com/mb/tradePartners

- https://blog.luxuryroof.in/tier-1-2-and-3-cities-in-india/

- https://journals.lww.com/indjem/fulltext/2022/07000/exercise_promotion_in_rural_areas.14.aspx

- https://www.muscleblaze.com

- https://intowellness.in/the-ultimate-guide-to-a-successful-gym-business-in-india-2025/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC8455010/

- https://www.justdial.com/Banka/Whey-Protein-Distributors-MUSCLEBLAZE/nct-11810885

- https://economictimes.com/jobs/hr-policies-trends/small-cities-big-growth-hiring-scene-hots-up-in-tier-2-3-cities/articleshow/122445973.cms

- https://www.justdial.com/Pune/Whey-Protein-Distributors-MUSCLEBLAZE/nct-11810885